Table of Contents

Running a small business or startup comes with plenty of challenges, and managing your finances is one of the most important. Whether you’re just starting out or looking to grow, getting your accounting right from the beginning is essential. It’s more than just tracking income and expenses—accounting provides the insight you need to make smart decisions, manage cash flow, and plan for sustainable growth.

In this guide, we’ll break down key accounting principles, bookkeeping essentials, and tips to help you stay on top of your finances and set your business up for long-term success.

Why Accounting is Critical for Small Businesses and Startups

For small businesses and startups, accounting is more than just crunching numbers. It’s the backbone of your financial health, helping you keep track of where your money is coming from and where it’s going. Proper accounting ensures that you’re aware of your cash flow, expenses, and profits, which are all crucial to running a successful business. It also helps you stay compliant with tax obligations, avoid costly penalties, and make informed decisions that support long-term growth.

Small businesses and startups often operate on tight budgets, and every dollar counts. Without a solid accounting system, it’s easy to lose sight of your financial position, which could lead to overspending, unpaid bills, or even bankruptcy. From day one, understanding and managing your finances sets you up for success.

How Accounting Impacts Business Growth and Sustainability

A solid accounting foundation is essential to growing and sustaining a small business or startup. By regularly tracking your financial performance, you can spot trends and opportunities for growth, allowing you to invest strategically in areas like marketing, staffing, or product development. On the flip side, accounting helps you identify potential risks, such as cash flow shortages or increasing debt, and take corrective action before they become major issues.

Accurate accounting also boosts your credibility with lenders and investors. Whether you’re applying for a loan or seeking funding, a clear picture of your financial health reassures stakeholders that your business is stable and ready to grow. It’s not just about managing day-to-day operations—it’s about preparing for the future.

Accounting for Business: Common Challenges for startups

Startups, especially in their early stages, face unique accounting challenges. Accounting for startups has some hurdles. One of the biggest hurdles is managing cash flow. Unlike established businesses, startups often experience inconsistent revenue, making it difficult to predict when and how much money will come in. At the same time, ongoing expenses like rent, utilities, and salaries need to be paid, creating a delicate balance between income and outflow.

Another challenge is tax compliance. Navigating Australia’s tax system can be tricky, especially for new business owners unfamiliar with GST, PAYG, or superannuation requirements. Incorrect filings or missed deadlines can lead to hefty fines, putting further strain on your financials.

Lastly, many startups struggle with maintaining accurate and up-to-date records. Often, the focus is on product development, marketing, or customer acquisition, leaving little time for bookkeeping. However, neglecting your financial records can result in inaccurate reporting, making it difficult to assess the true health of your business and plan effectively for the future.

Key Accounting Principles for Small Businesses

These principles help you manage finances effectively, make informed decisions, and ensure your business stays on a stable financial path.

Understanding the Basics: Assets, Liabilities, and Equity

Before diving into accounting, it’s essential to understand the three pillars that form the foundation of your business’s financial position: assets, liabilities, and equity. These components paint a clear picture of what your business owns, what it owes, and how much is left for you, the owner.

Assets are anything of value that your business owns, like cash, equipment, or inventory. They represent resources that can generate future income.

Liabilities are the debts or obligations your business has to others. This could include loans, unpaid invoices, or rent. Simply put, liabilities are what your business owes.

Equity is what’s left once you subtract liabilities from assets. It represents the ownership interest in your business. As a small business owner, equity reflects your stake in the company—whether it’s the money you’ve invested or profits you’ve kept in the business.

Keeping a close eye on these basics helps you understand the financial health of your business. It’s crucial for making informed decisions and ensuring you’ve got a clear view of where you stand at any given moment.

Cash vs Accrual Accounting: Which is Best for Your Business?

When it comes to accounting, small business owners often face a key decision: cash accounting or accrual accounting. Both methods are legitimate, but each has its pros and cons depending on the nature of your business.

Cash Accounting is simple and straightforward. You record income when it’s received and expenses when they’re paid. This method works well for smaller businesses with straightforward business transactions. It gives a clear picture of your cash on hand and is easy to maintain.

Accrual Accounting is a bit more complex but provides a more accurate reflection of your business’s financial performance. Here, you record income when it’s earned (even if you haven’t been paid yet) and expenses when they’re incurred (even if you haven’t paid them yet). This method gives a better long-term view of your finances, particularly for businesses with multiple projects or long-term contracts.

Choosing between cash and accrual accounting often depends on your business’s size and complexity. For small businesses and startups, cash accounting might seem easier to manage, but as your business grows, accrual accounting could offer better insights into your overall financial health. Either way it is vital to maintain records of all business transactions.

Importance of the Double-Entry System

In accounting, the double-entry system is the gold standard, and for good reason. It’s built on the principle that every transaction affects at least two accounts: one is debited, and the other is credited. This method keeps your books balanced and ensures that every dollar is properly accounted for.

For small business owners, double-entry accounting is invaluable because it provides a more comprehensive view of your financial activities. It helps prevent errors, detect discrepancies, and maintain accurate records. This system also ensures your assets always equal liabilities plus equity, making it easier to track profitability and monitor the financial health of your business.

In the long run, adopting the double-entry system adds structure and reliability to your accounting, setting your business up for success and giving you confidence in your financial reporting.

Bookkeeping Essentials for Startups

Recording Financial Transactions: Income, Expenses, and Receipts

When you’re running a startup, recording every financial transaction is vital. It’s all about keeping a detailed and accurate log of what’s coming in and what’s going out. For every dollar of income your business earns—whether it’s from sales, services, or investments—you need to record it properly. Likewise, for every expense—from supplier payments to office rent—it’s essential to keep a record. And don’t forget receipts, which act as proof of purchase for any business-related expenses.

Accurate transaction recording helps you stay on top of your finances and is crucial when tax time rolls around. Plus, it allows you to monitor your cash flow, ensuring you always know where your money’s going and what you’re left with.

Importance of Accurate and Regular Bookkeeping

Bookkeeping isn’t just a chore—it’s the backbone of your startup’s financial health. Keeping accurate and regularfinancial records ensures that you’re always on top of things. It’s not just about meeting legal obligations; it’s about staying informed about your financial position. Without regular bookkeeping, you risk overlooking unpaid invoices, missing out on deductions, or worse—running out of cash without realising it.

By setting aside time each week (or hiring someone to do it), you’ll have a clear snapshot of how your business is performing. And if you ever need to secure funding or bring in investors, having up-to-date records is a must.

Tracking Business Expenses and Receipts Efficiently

Every startup has expenses—from purchasing stock to paying bills—and it’s crucial to track them efficiently. Not only does this help manage cash flow, but it also ensures you’re ready for tax season. Australia’s tax system allows you to claim deductions on certain business expenses, so keeping your receipts in order could save you a significant amount of money.

To track expenses efficiently, categorise them properly. This could include rent, utilities, marketing, or travel. Each category gives you insight into where your money is going and how you can manage costs better. It’s also a good idea to store all receipts, either in a filing system or, better yet, digitally—so you have easy access when you need it.

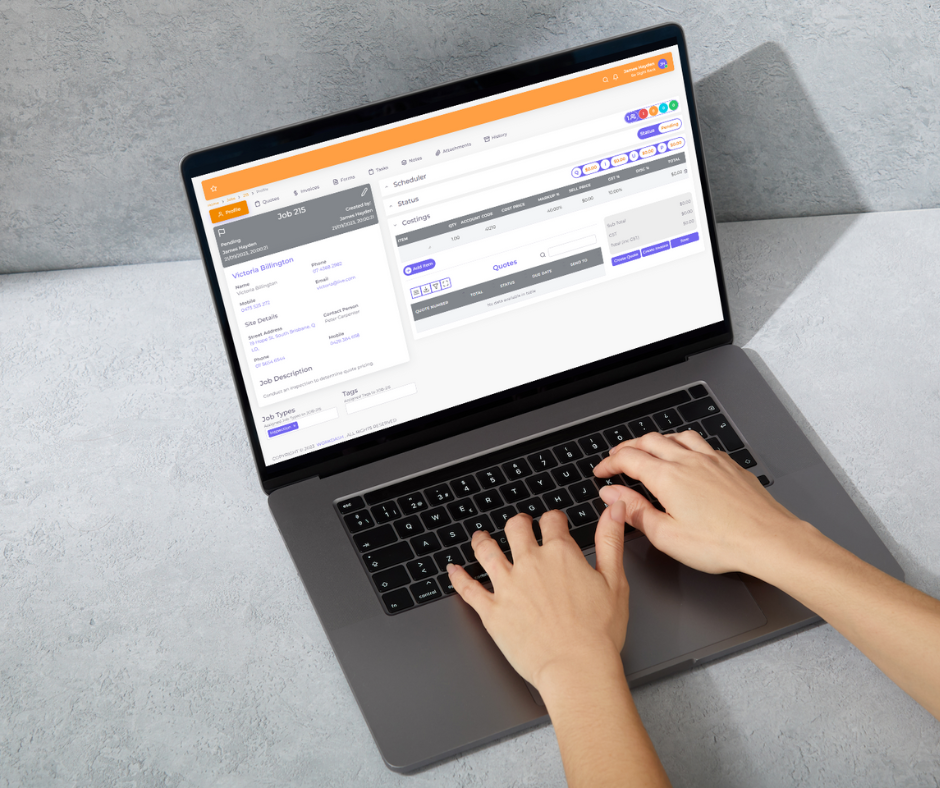

Automating Bookkeeping Processes with Software

Manual bookkeeping is time-consuming, and mistakes can easily slip through the cracks. That’s where automating your bookkeeping can make life much easier. There are plenty of great accounting software out there that can help automate tasks like tracking income, logging expenses, and even generating financial reports

These tools can also connect directly to your bank account, automatically categorising transactions and keeping everything up-to-date in real time. This means you’ll spend less time on tedious admin tasks and more time focusing on growing your startup. Automating your bookkeeping doesn’t just save time; it reduces the risk of errors, making your financial management smoother and more reliable.

Automating transactions against bank statements is an effective accounting process that ensures you are always on top of your financial obligations.

Budgeting and Forecasting for Small Businesses

Budgeting is the lifeline of any small business or startup. It provides a clear roadmap for where your money is going and helps you allocate resources wisely. For startups, in particular, creating a budget isn’t just important—it’s essential for survival. Without one, it’s easy to lose track of cash flow, overspend, or run into unexpected financial roadblocks. A well-planned budget ensures you can cover your day-to-day expenses while still investing in growth opportunities. It also gives you the confidence to make informed decisions, knowing you’ve got a solid financial foundation to back them up.

Creating a Realistic Budget

Building a budget that works for your business starts with being realistic. Many startups make the mistake of overestimating their income or underestimating their expenses. To avoid this, start by listing all your known expenses—rent, utilities, marketing, and wages, to name a few—and make sure to account for any variable costs that may pop up. On the income side, be conservative in your estimates, especially if your business is still gaining traction.

Remember, it’s better to create a modest budget that you can stick to rather than an overly ambitious one that leaves you strapped for cash. Keep your budget simple, clear, and adaptable, so you can easily adjust as your business grows.

Monitoring and Adjusting Your Budget as You Grow

Your budget isn’t something you create once and forget about. As your business grows, it’s crucial to regularly monitor your financial performance and adjust your budget accordingly. Regular check-ins—monthly, quarterly, or annually—allow you to spot any discrepancies between your projected income and actual revenue, as well as any unexpected expenses.

Perhaps you’ve landed a new contract and need to invest more in staffing, or maybe you’ve noticed an opportunity to cut costs in one area and reallocate funds to another. Whatever the case, being flexible with your budget will help you stay on track and make sure your business is in the best financial position to keep growing.

Financial Forecasting to Support Business Planning

While budgeting is about managing your current finances, financial forecasting looks to the future, helping you predict what’s to come. For small businesses and startups, forecasting is a valuable tool for planning. It allows you to anticipate future cash flow, spot potential risks, and seize opportunities for expansion.

By analysing trends and reviewing your business’s historical performance, you can forecast how much revenue you’re likely to generate and what expenses you’ll need to cover in the coming months or years. These forecasts are particularly useful when seeking funding or planning major investments, as they give stakeholders a clear picture of your business’s future potential.

Incorporating forecasting into your regular business planning helps you stay proactive, ensuring you’re not just reacting to financial surprises but planning ahead for sustainable growth.

Cash Flow Management

Effective cash flow management is crucial for the survival and growth of small businesses. It’s all about ensuring there’s enough money coming in to cover your expenses and keep operations running smoothly. Let’s take a closer look at why cash flow is so important and how you can manage it to safeguard your business’s financial health.

Why Cash Flow is the Lifeblood of Small Businesses

For any small business, cash flow is the financial fuel that keeps everything moving. Unlike large corporations, small businesses often don’t have huge cash reserves to fall back on, so a consistent flow of money is essential. Whether it’s paying staff, covering rent, or purchasing stock, positive cash flow ensures you can meet your day-to-day financial commitments.

If your business spends more than it brings in over an extended period, you’ll face cash shortages, which can quickly lead to missed payments, late fees, or even insolvency. That’s why managing cash flow is vital—it keeps your business flexible and able to respond to both challenges and opportunities as they arise.

Cash Flow Projections and Tracking

One of the best ways to stay on top of your finances is by creating cash flow projections. These forecasts give you a picture of your expected income and expenses over a specific period, allowing you to plan ahead. By projecting your cash flow, you can identify potential shortfalls or surpluses and take action before problems arise.

Tracking your actual cash flow against these projections is equally important. Regularly monitoring your financial position—weekly or monthly—ensures you’re aware of how well your business is performing. It also allows you to adjust your projections if needed, making sure you stay in control of your finances.

Strategies to Improve Cash Flow

Improving cash flow doesn’t have to be complicated. A few simple strategies can make a world of difference. First, consider tightening your payment terms with customers. Offering shorter payment periods or discounts for early payments can encourage customers to pay faster. You might also want to explore invoice financing to get cash upfront for unpaid invoices.

Another way to improve cash flow is by reducing unnecessary expenses. Regularly review your outgoings and identify areas where you can cut costs without sacrificing quality or service. Additionally, focusing on stock management—making sure you’re not over-ordering or sitting on excess inventory—can free up cash that’s otherwise tied up in goods.

Managing Late Payments and Debt Collection

Late payments from customers can wreak havoc on your cash flow, especially for small businesses. Establishing clear payment terms upfront and sending invoices promptly is the first step in managing late payments. However, when payments are overdue, it’s crucial to have a system in place for debt collection.

Start by sending friendly reminders as soon as an invoice is overdue. If that doesn’t work, a more formal follow-up or engaging a professional debt collection service may be necessary. The key is to remain professional and consistent while protecting your business from financial strain caused by unpaid debts.

Accounting for Business Growth

As your business grows, so do your accounting needs. Whether you’re expanding your operations, increasing revenue, or entering new markets, scaling your accounting processes is essential to ensure your financial systems can support your business at every stage. Here’s how to manage accounting during growth phases to keep your finances on track.

Scaling Your Accounting Processes as Your Business Grows

As your small business evolves, your accounting processes need to keep up. What worked when you had a handful of transactions might not be sufficient as your business grows. Scaling your accounting involves streamlining and automating tasks, such as invoicing, payroll, and expense management, to handle increased complexity and volume.

Cloud-based accounting software is particularly useful during growth phases, allowing you to track income, expenses, and tax obligations more efficiently. As your team expands, you’ll also need systems in place for managing payroll and superannuation obligations seamlessly. The key is to adopt processes that not only handle your current needs but can easily grow with you.

Tracking Costs, Revenue, and Profitability During Growth Phases

Growth can be exciting, but it often comes with increased costs. It’s important to track these alongside your revenue to ensure you’re maintaining profitability. As your business expands, you may incur additional costs—such as higher payroll, increased stock, or new marketing expenses—that can eat into your profits if not carefully managed.

By regularly reviewing your financial reports, you can monitor your profit margins and identify areas where you may need to adjust pricing, reduce costs, or increase sales. Keeping a close eye on your financial health during growth phases ensures that your business remains sustainable and profitable as you scale.

Expanding to New Markets: Accounting Considerations

If you’re a startup owner and are looking to expand into new markets, there are several accounting considerations to keep in mind. Different regions may have unique tax laws, financial regulations, and compliance requirements. Whether you’re expanding interstate or internationally, you’ll need to understand these local obligations to ensure your business stays compliant.

Currency exchange rates, import/export taxes, and new supply chain costs can all impact your bottom line. Before entering a new market, consult with an accountant or financial advisor who understands the local laws and regulations. This will help you avoid any costly mistakes and set your business up for successful expansion.

Managing Business Loans and Funding

Securing business loans or external funding is often a critical part of growing a small business. However, it’s essential to manage this funding carefully to avoid financial strain. Loans come with repayment schedules and interest, which need to be factored into your cash flow and budget.

Additionally, if you’re working with investors, you’ll need to provide detailed financial reporting to keep them informed about your business’s performance. Maintaining clear and transparent accounting records will not only ensure you meet these obligations but also help you track how funds are being used to support growth. Proper loan and funding management ensures you’re investing in growth without jeopardising your business’s financial stability.

Accounting Compliance and Audits

Ensuring your business is financially compliant is a key part of maintaining its reputation and longevity. In Australia, there are strict regulations and standards you need to meet to avoid penalties and ensure your business is running smoothly. Here’s how to stay on top of accounting compliance and what to expect if you’re audited.

Understanding Financial Compliance Requirements in Australia

Australian businesses must adhere to several financial compliance requirements, from lodging Business Activity Statements (BAS) for GST to managing PAYG tax and superannuation for employees. Staying compliant involves more than just filing tax returns—it’s about keeping accurate financial records, meeting deadlines, and adhering to the Australian Accounting Standards.

Depending on your business structure, you may also be required to submit financial reports to ASIC or comply with industry-specific regulations. It’s essential to understand what obligations apply to your business and stay up to date with changes in tax and business laws. Keeping on top of your compliance requirements ensures you’re always in good standing with the ATO and other governing bodies.

Preparing for Audits and Financial Reviews

An audit can be stressful, but if you’re well-prepared, it’s simply a review of your financial records to ensure everything’s in order. Audits are designed to check for compliance with accounting laws and regulations, as well as to verify that your financial statements accurately reflect your business’s financial position.

To prepare for an audit, ensure all your records are up to date and easily accessible. This includes tax documents, financial statements, payroll records, and any relevant contracts or invoices. A well-organised system will not only make the audit process smoother but also demonstrate that your business is transparent and compliant with the law. Regularly reviewing your finances with an accountant can also help you identify any issues before they become a problem during an audit.

Record-Keeping Best Practices for Compliance

Accurate record-keeping is essential for both compliance and audit readiness. In Australia, businesses are required to keep financial records for at least five years. These records include invoices, receipts, tax returns, payroll documents, and any financial statements.

Using accounting software is a great way to keep your records organised and accessible. It also makes it easier to track income and expenses, file tax returns, and stay compliant with the ATO. Implementing digital systems ensures that your records are accurate and secure, and having them readily available will save you time if you’re audited or need to file financial reports.

Avoiding Common Accounting Penalties

Many businesses face penalties simply because they’re unaware of certain compliance requirements or make mistakes in their accounting. The most common accounting penalties include late tax lodgements, underpayment of taxes, or failure to withhold the correct amount for PAYG.

To avoid these penalties, ensure you understand all your tax obligations, including BAS lodgement deadlines, payroll tax requirements, and superannuation contributions. Regularly reviewing your finances and seeking professional advice can help you avoid costly errors and ensure your business stays compliant with Australian laws.

Accounting Tools and Technology for Startups

For startups, the right accounting tools can significantly simplify financial management. Here’s a look at essential software and how cloud-based systems, integration, and automation can streamline your processes.

Benefits of Cloud-Based Accounting Systems

Cloud-based accounting allows access to your financial data anytime, anywhere. With automatic updates and real-time backups, these systems ensure your information is secure and up-to-date, making them ideal for modern startups.

Integration with Other Business Tools (CRM, Inventory, Invoicing)

Modern accounting software can integrate with other business tools like CRM, inventory, and invoicing systems. This saves time by automating tasks and syncing financial data, giving you a clearer view of your cash flow.

Leveraging AI and Automation in Accounting

AI and automation can reduce manual tasks like payroll and expense tracking. These tools offer valuable insights and increase accuracy, allowing you to focus on strategic decisions as your startup grows.

Common Accounting Mistakes for Startups and How to Avoid Them

Starting a business comes with its fair share of challenges, and accounting is no exception. Many startups fall into common traps when managing their finances, but with a bit of foresight, these mistakes can easily be avoided. Here’s how to sidestep some of the most frequent accounting errors.

Ignoring Bookkeeping and Financial Statements

It’s easy for startups to get caught up in the day-to-day operations and neglect their bookkeeping. However, ignoring financial statements means you lose track of where your money is going. To avoid this, set up a regular bookkeeping routine and review your financial statements monthly. This will give you a clear snapshot of your business’s financial health and help you spot any potential issues early.

Failing to Separate Personal and Business Finances

Mixing personal and business finances is a recipe for disaster. Not only does it complicate your bookkeeping, but it can also lead to tax problems down the line. From day one, open a separate business bank account and keep your personal spending away from business expenses. This makes tracking your finances easier and keeps things clean for tax time.

Underestimating Tax Liabilities

Many startups get a nasty shock when they realise they haven’t set aside enough for taxes. It’s crucial to understand your tax obligations early on and make regular payments to avoid falling behind. Working with an accountant can help you estimate your liabilities and ensure you’re staying on top of your tax responsibilities throughout the year, rather than scrambling at the last minute.

Poor Cash Flow Management

Failing to manage your cash flow effectively can sink a startup, even if it’s making a profit on paper. It’s not enough to look at revenue alone; you need to know when money is coming in and going out. Creating a cash flow forecast will help you plan ahead and avoid shortfalls, especially during leaner months. Always keep an eye on outstanding invoices and try to maintain a healthy buffer in your account for unexpected expenses.

Not Seeking Professional Help When Needed

Many startups try to do everything themselves, but accounting is one area where seeking professional advice can make all the difference. Whether it’s managing your taxes, ensuring compliance, or getting help with complex financial matters, engaging an accountant or bookkeeper early on can save you time, money, and stress in the long run.

Common Accounting Mistakes for Startups and How to Avoid Them

Startups can easily fall into accounting traps, especially in the early stages when resources are tight. Mistakes in managing finances can quickly snowball into bigger problems, but with some attention to detail and the right approach, you can avoid them. Here are five common accounting mistakes startups make and tips on how to avoid them.

Ignoring Bookkeeping and Financial Statements

It’s tempting to focus on growth and neglect bookkeeping, but ignoring your financial records can put your business at risk. Without regular bookkeeping and reviewing financial statements, it’s easy to lose track of income, expenses, and cash flow. To avoid this, commit to updating your books consistently and reviewing your profit and loss statements monthly. Staying on top of your numbers will help you make better financial decisions and avoid surprises down the track.

Failing to Separate Personal and Business Finances

Blurring the lines between personal and business finances is a common mistake for new entrepreneurs. Mixing the two can lead to confusion, make bookkeeping a nightmare, and create tax issues. The fix is simple: open a separate business bank account as soon as possible. This keeps your transactions clean and organised, making it easier when tax season rolls around, and it gives you a clearer picture of your business’s performance.

Underestimating Tax Liabilities

A lot of startups underestimate how much they’ll owe in taxes, and it can be a rude shock when the bill comes in. Whether it’s income tax, GST, or PAYG obligations, getting it wrong can leave you with a significant shortfall. Set aside money for tax from the beginning and work with an accountant to estimate your liabilities. Regular tax planning will keep you compliant and prevent you from falling behind, giving you peace of mind.

Poor Cash Flow Management

Cash flow is the lifeblood of any business, and poor management of it can be fatal, even for profitable companies. It’s not enough to just know your sales and revenue; you need to stay on top of when cash is coming in and going out. Set up a cash flow forecast to track your payments and expenses over time. This will help you identify potential shortfalls and give you time to take action before cash dries up.

Not Seeking Professional Help When Needed

Many startup founders think they can handle all aspects of their business, but accounting can get complex quickly. Whether it’s understanding compliance obligations, managing payroll, or preparing for tax season, bringing in a professional accountant or bookkeeper can save you a lot of headaches. Don’t wait until things go wrong – get the advice you need early on to keep your finances in order.

Summary

In today’s competitive business landscape, effective accounting practices are crucial for small businesses aiming for long-term success. By implementing key accounting tips, regularly monitoring financial health, and adapting practices as your business evolves, you can enhance your financial management and drive growth. Remember, staying organised and proactive in your accounting not only simplifies your processes but also positions your business for future success.

Ready to take your business management to the next level? Book a Demo now!

With WorkDash, you can streamline your accounting processes, gain real-time financial insights, and ensure your business is always on track. See how our comprehensive software can transform your financial management and support your growth ambitions!