Table of Contents

Ensuring your business follows the rules and regulations is crucial for long-term success in Australia. If you don’t stay on top of compliance, you could face hefty fines, damage your reputation, and even risk shutting down your operations. This guide will take you through the key areas of business compliance in Australia, giving you a clear understanding of what’s involved and how to stay on the right side of the law.

What is Business Compliance?

Business compliance is all about making sure your business follows the laws, regulations, and industry standards that apply to your operations. In Australia, this can cover everything from paying your workers correctly to protecting your customers’ data and meeting environmental standards.

Not following the rules can result in serious consequences, such as:

Fines – Non-compliance can lead to significant financial penalties.

Reputation damage – Losing the trust of your customers and the public can be devastating for any business.

Legal action – You could face lawsuits or be forced to stop operating.

Business shutdown – In extreme cases, non-compliance can lead to the closure of your business.

Understanding your compliance obligations is essential for staying on the right path and avoiding unnecessary risks.

Why is Business Compliance Important in Australia?

Australia has a robust legal framework that ensures businesses operate fairly, safely, and ethically. Compliance is about more than just ticking boxes—it helps build trust with customers, employees, and regulators. When your business complies with the law, you’re showing you care about doing the right thing, which can positively impact your brand and bottom line.

Being compliant also means:

Avoiding legal trouble – Following the rules helps you steer clear of costly disputes and penalties.

Building trust – Customers are more likely to do business with companies that follow ethical and legal guidelines.

Protecting your workforce – Compliance with workplace safety laws means a safer environment for your employees.

Enhancing reputation – A compliant business is seen as more trustworthy, attracting customers, investors, and partners.

Key Areas of Business Compliance in Australia

Workplace Health and Safety (WHS)

Australia’s Work Health and Safety Act 2011 requires businesses to ensure the safety and health of their workers. WHS compliance means identifying hazards, reducing risks, and creating a safe working environment.

Key requirements include:

Risk assessments – Regularly identify and assess risks in the workplace.

Safety policies – Have clear safety policies and procedures in place.

Training – Provide training and safety equipment to employees.

Incident reporting – Implement systems to report and investigate incidents.

Failing to comply with WHS regulations can result in significant fines and even jail time for directors. If an employee is injured due to non-compliance, the business could be liable for compensation and face severe legal consequences.

Privacy and Data Protection (Australian Privacy Principles)

Under the Privacy Act 1988, businesses that handle personal information must comply with the Australian Privacy Principles (APPs). These principles dictate how businesses should collect, use, and store personal data.

Key requirements include:

Transparency – Be upfront with customers about how their personal information is collected and used.

Security – Protect personal data from unauthorised access or breaches.

Access – Allow individuals to access and correct their personal information.

Deletion – Ensure that personal information is only retained for as long as necessary.

With data breaches becoming more frequent, complying with privacy laws is critical to maintaining customer trust and avoiding hefty fines.

Employment Law Compliance (Fair Work Act)

The Fair Work Act 2009 governs employment relationships in Australia, including pay, entitlements, and workplace conditions. As an employer, you must ensure that your business complies with these regulations to avoid disputes and legal challenges.

Key requirements include:

Minimum wage – Ensure employees are paid at least the minimum wage as set out by modern awards.

Leave entitlements – Provide employees with the correct leave entitlements, including annual leave, sick leave, and parental leave.

Fair working conditions – Offer a safe, non-discriminatory work environment.

Termination procedures – Follow lawful procedures when dismissing employees to avoid unfair dismissal claims.

The Fair Work Ombudsman provides tools and resources to help businesses understand and comply with employment laws. Failing to comply can lead to legal claims, fines, and damage to your business’s reputation.

Environmental Compliance

Australia’s Environment Protection and Biodiversity Conservation Act 1999 ensures businesses are mindful of their environmental impact. Environmental compliance involves reducing emissions, managing waste responsibly, and ensuring that your operations do not harm ecosystems.

Key requirements include:

Waste management – Properly manage and dispose of waste in line with environmental regulations.

Energy efficiency – Reduce energy consumption and minimise emissions.

Hazardous materials – Handle hazardous materials safely and in compliance with the law.

Environmental compliance is becoming increasingly important, with consumers and governments alike demanding that businesses operate sustainably. Failing to meet environmental regulations can lead to fines, legal action, and negative publicity.

Taxation Compliance (Australian Taxation Office)

The Australian Taxation Office (ATO) requires businesses to comply with various tax obligations, including Goods and Services Tax (GST), payroll tax, and corporate tax. Proper financial reporting and record-keeping are essential to meeting your tax obligations.

Key requirements include:

GST registration – Register for GST if your business has an annual turnover of $75,000 or more.

Accurate tax reporting – Lodge tax returns on time and report income and expenses accurately.

Payroll tax – Pay the correct amount of payroll tax for employees.

Superannuation – Ensure superannuation payments are made on behalf of eligible employees.

Non-compliance with tax laws can result in audits, fines, and penalties. Regularly reviewing your financial systems and seeking advice from accountants or tax professionals can help ensure you meet your obligations.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF)

Businesses operating in certain industries must comply with Australia’s Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) laws, overseen by AUSTRAC. This includes financial services, real estate, and gambling sectors.

Key requirements include:

Customer due diligence – Verify customer identities and report any suspicious transactions.

Reporting obligations – Submit reports on transactions that meet certain thresholds or are suspicious.

Record-keeping – Maintain detailed records of financial dealings.

Failing to comply with AML/CTF laws can result in severe penalties, including fines and imprisonment. Businesses must have strong procedures in place to identify and mitigate risks.

Australian Consumer Law (ACL)

The Competition and Consumer Act 2010 governs the relationship between businesses and consumers in Australia. Australian Consumer Law (ACL) requires businesses to treat consumers fairly and ensure that products and services meet certain standards.

Key requirements include:

Product safety – Ensure all products meet safety standards.

Advertising – Avoid false or misleading claims in advertising and marketing.

Refunds and repairs – Offer refunds, repairs, or replacements when goods are faulty or don’t meet expectations.

Complying with ACL is essential to maintain consumer trust and avoid fines and legal action. The Australian Competition and Consumer Commission (ACCC) enforces these laws and can take action against businesses that breach them.

Modern Slavery Act Compliance

Australia’s Modern Slavery Act 2018 requires businesses with a turnover of $100 million or more to report on their efforts to address modern slavery in their supply chains. This involves identifying and mitigating risks of forced labour, human trafficking, and other forms of exploitation.

Key requirements include:

Risk assessments – Identify risks of modern slavery in your supply chains.

Reporting – Submit an annual modern slavery statement outlining the steps taken to mitigate risks.

Supplier transparency – Work with suppliers to ensure ethical practices throughout the supply chain.

Failing to comply with the Modern Slavery Act can result in reputational damage and regulatory action. Businesses should prioritise transparency and ethical sourcing to meet their obligations.

Cybersecurity Compliance

With cyber threats on the rise, businesses in Australia must ensure they comply with cybersecurity standards set out by the Australian Cyber Security Centre (ACSC). This includes protecting sensitive data and preventing unauthorised access to business systems.

Key requirements include:

Data security – Implement strong cybersecurity measures to protect data.

Access control – Ensure only authorised individuals can access sensitive information.

Incident response – Have a plan in place to respond to data breaches or cyber attacks.

Non-compliance with cybersecurity standards can lead to data breaches, financial losses, and damage to your business’s reputation. Regularly reviewing your cybersecurity measures and training staff on security protocols can help protect your business.

ASIC Reporting and Corporate Governance

The Australian Securities and Investments Commission (ASIC) regulates corporate governance and financial reporting in Australia. All registered companies must comply with ASIC’s reporting requirements, including submitting annual financial statements and maintaining accurate company records.

Key requirements include:

Financial reporting – Lodge annual financial reports with ASIC.

Director duties – Ensure directors meet their legal responsibilities, such as acting in the best interests of the company.

Corporate governance – Maintain transparent and responsible corporate governance practices.

Non-compliance with ASIC requirements can result in penalties, legal action, or even disqualification of directors.

Developing your Own Compliance Program for Your Business

Creating a compliance plan is essential for ensuring that your business meets all legal obligations. Follow these steps to develop an effective plan:

Identify regulations – Understand the laws and regulations that apply to your industry.

Assess risks – Review current operations to identify compliance gaps.

Create policies – Develop clear policies and procedures to ensure compliance.

Train employees – Ensure all staff understand their role in compliance.

Monitor and review – Regularly review and update your compliance plan to adapt to any changes in regulations.

Final Thoughts on Business Compliance in Australia

Staying on top of business compliance in Australia is crucial to protecting your business and its reputation. While it may seem complex, understanding your obligations and developing a solid compliance plan will help you avoid costly penalties and keep your business operating smoothly. Regularly consult legal or compliance professionals to ensure you’re up to date with changes in regulations and maintain best practices across your business.

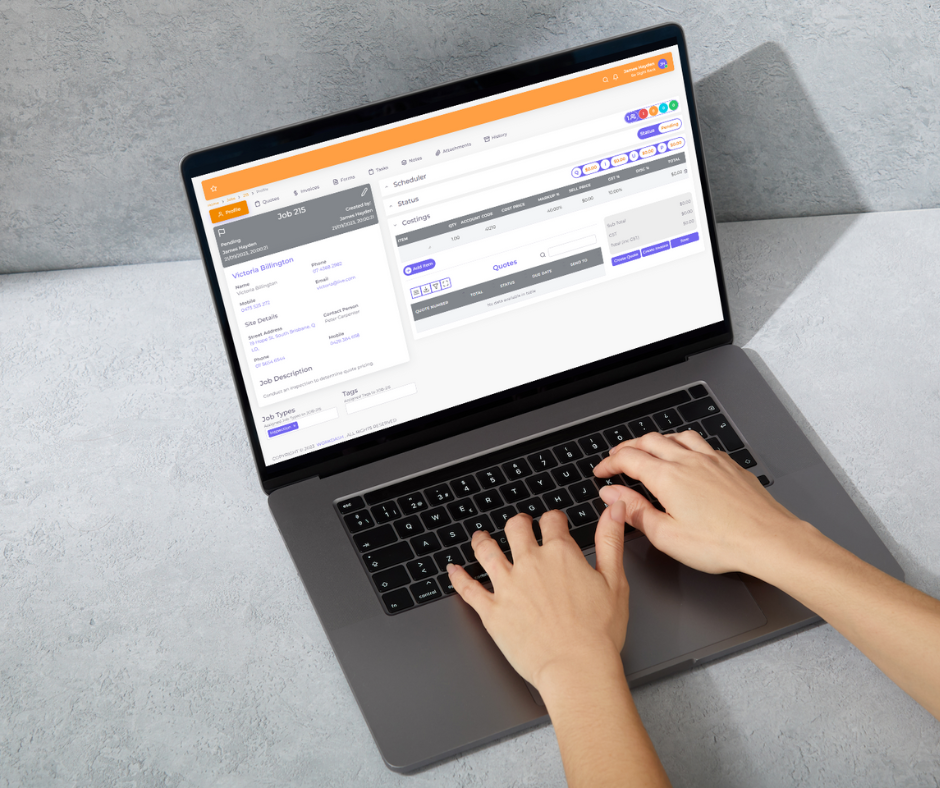

Ready to take the stress out of managing business compliance? Discover how WorkDash’s Compliance Feature can help you stay on top of regulations, reduce risks, and ensure your business is always operating within the law. Book a demo today and see how easy compliance management can be with WorkDash!