Table of Contents

Invoicing is a crucial aspect of managing any business, whether large or small. It’s essential for ensuring smooth cash flow, maintaining proper records, and keeping customers happy.

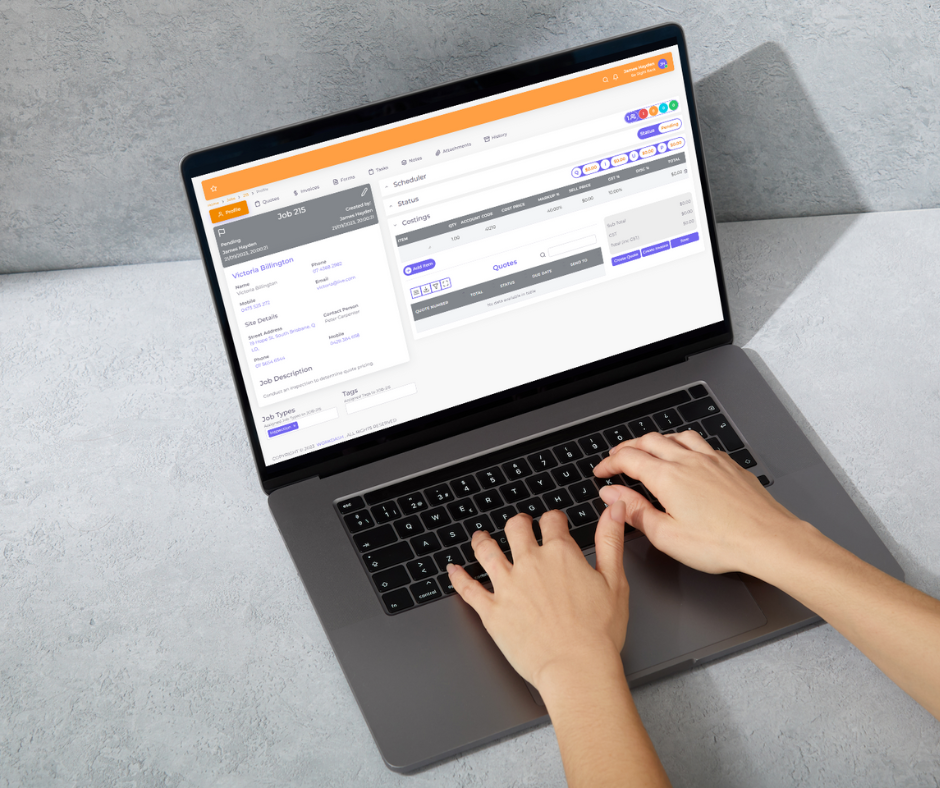

Invoice software provides a powerful solution to streamline the billing and payment processes, helping businesses automate their invoicing system and eliminate manual tasks. By adopting online invoicing software, Australian businesses can enjoy significant time savings and reduce human errors associated with traditional methods.

In this article, we’ll explore the 10 benefits of online invoicing, highlighting how automated invoicing and invoice software can transform your billing process and improve cash flow management.

Invoice automation software should also include PDF automated invoicing systems rather than manual invoicing methods that are prone to human errors.

Let’s dive into the key reasons why businesses of all sizes should consider moving to electronic invoicing solutions to create invoices.

Streamlined Invoice Software

One of the primary advantages of invoice software is its ability to streamline the billing process. Instead of manually creating, tracking, and sending invoices, online invoicing software automates these tasks, reducing the amount of time and effort needed to generate invoices online.

With automated invoicing, businesses can set up recurring online invoices, ensuring that customers receive their bills promptly without the need for manual intervention. This eliminates tedious manual data entry, helping you save time and focus on other important aspects of your business.

Additionally, the invoice template options available in most invoice software make it easy to create consistent, professional invoices that align with your brand.

Faster Invoice Payments and Cash Flow Management

Faster payments are crucial for maintaining a healthy cash flow, and online invoicing software can significantly help in this regard. By automating the invoicing process, businesses can send online invoices as soon as a service is rendered or a product is delivered. This ensures timely billing and encourages quicker payment from customers.

Furthermore, automated reminders can be set up to notify clients of upcoming due dates, reducing delays in payment processing. This streamlined payment process helps businesses improve their cash flow and track overdue invoice payments efficiently, so you can stay on top of outstanding invoices and avoid cash flow gaps.

Automation of Electronic Invoicing

Professional-looking invoices play a big role in portraying a trustworthy image to clients. With invoice software, you can create and send invoices with ease, using customisable invoice templates that reflect your business’s unique branding.

By including your logo, business contact details, and relevant payment instructions, your online invoice will look polished and professional. This personalisation not only enhances your business’s image but also makes it easier for clients to understand the details of their billing. Automated invoicing provides a seamless payment experience for customers that delivers timely payment methods over traditional invoicing methods.

Efficient Record-Keeping and Compliance

Invoice software makes record-keeping a breeze by automatically storing all invoice data in a centralised location. With e-invoicing systems, businesses can access their past invoices at any time, saving you from searching through piles of paperwork.

Additionally, the software ensures that your invoicing practices align with Australian tax laws and regulations. With the push towards electronic invoicing and the growing trend of e-invoicing, maintaining compliance has never been easier. Many invoice software solutions integrate with accounting tools to provide seamless reporting and tax preparation.

Real-Time Financial Insights

Having access to real-time data is a significant benefit of using invoice software. With advanced reporting features, you can track the status of every invoice, including which ones have been paid, which are overdue, and which need follow-up.

This gives you a clear picture of your financial situation, helping you make informed decisions about your business’s future. The software offers real-time insights into your payment process, allowing you to optimise your invoicing strategy and keep your finances on track.

Cost-Effective Solution for Small to Medium Businesses

Invoice software offers an affordable invoicing solution, particularly for small and medium-sized businesses that might struggle with the cost of traditional accounting services. By moving away from paper invoices and manual processes, businesses can reduce the cost of invoicing.

Additionally, online invoicing software helps eliminate the need for paper, ink, and postage, further reducing operational costs. These cost savings can then be reinvested into the business, helping it grow and thrive.

Enhanced Security and Data Protection

In an age where data breaches are increasingly common, online invoicing software provides enhanced security for your sensitive financial information. With secure, cloud-based storage, your invoice data is protected from loss or theft, and you can access it anytime, from anywhere.

Many invoicing platforms also offer payment gateways that provide secure payment options, ensuring a safe and reliable payment process. Plus, with automated invoicing, your data is automatically encrypted, adding another layer of protection for both you and your customers.

Integration with Other Business Tools

Invoice software can easily integrate with other business solutions such as accounting software, customer relationship management (CRM) platforms, and inventory management tools. This integration allows you to create and send invoices without the need for double data entry or manual syncing of information.

By automating data transfer between systems, you can reduce the risk of errors and ensure that all your business operations work together smoothly. The seamless connection between invoice software and other software solutions will help streamline your entire business workflow.

Conclusion

In summary, online invoicing software offers a wide range of benefits that can help your business grow and thrive. From automating the invoicing process and speeding up payment collection to improving the professionalism of your invoices and maintaining compliance with Australian regulations, invoice software is an essential tool for modern businesses.

The 10 benefits of online invoicing demonstrate why businesses of all sizes should consider automating their invoicing systems. If you’re looking for an easy way to improve your billing process, reduce errors, and get paid faster, invoice software is the way to go.

Start your free trial today and save time and money.