Table of Contents

Maintaining healthy cash flow is a cornerstone of financial success for any business. Whether you’re a small startup or an established enterprise, the ability to manage cash flow effectively can make the difference between thriving and struggling. By adopting robust cash flow management practices, business owners can avoid pitfalls such as insufficient liquidity and unexpected expenses while fostering growth and stability.

In this comprehensive guide, we’ll explore the principles of cash flow, its types, challenges, strategies to improve cash flow, and tools for maintaining a strong financial position.

Understanding Cash Flow

Cash flow is the movement of money into and out of a business, encompassing cash inflows such as revenues and investments, and cash outflows like operating expenses, debt repayments, and payroll. Maintaining a positive balance ensures that a business has enough cash to meet its obligations. Cash flow stability will optimise your cash and keep your business cash flow and financial position in a strong position.

Types of Cash Flow

- Operating Cash Flow: Funds generated from primary business operations, reflecting the company’s core financial health.

- Investing Cash Flow: Money spent or earned from investments, such as purchasing equipment or selling assets.

- Financing Cash Flow: Cash movement related to financing activities, like loans and equity investments.

Understanding these types of cash flow helps business owners gain insights into their company’s financial dynamics.

The Importance of Cash Flow Management

Cash flow management is essential for maintaining liquidity and ensuring long-term sustainability. Effective management ensures that businesses can:

- Cover operational expenses.

- Invest in growth opportunities.

- Maintain adequate cash reserves for emergencies.

- Avoid periods of negative cash flow that could jeopardise stability.

Effective cash flow management ensures you have enough cash on hand to maintain financial health of your business.

Common Cash Flow Challenges

Many businesses face cash flow challenges that can strain their financial health. Common issues include:

- Late Payments: Customers delaying invoices can create cash shortages.

- High Operational Costs: Rising expenses can reduce positive cash flow.

- Seasonal Fluctuations: Variations in demand can impact revenue consistency.

- Inventory Management Issues: Excess or insufficient stock ties up working capital.

Identifying and addressing these cash flow problems is vital for maintaining a stable financial position.

How to Create a Cash Flow Forecast

A cash flow forecast is an essential tool for predicting future cash inflows and cash outflows, allowing businesses to plan effectively.

Steps to Create a Cash Flow Forecast

- Analyse Past Cash Flow Statements: Review historical data to identify trends.

- Estimate Future Revenues: Use realistic projections based on sales pipelines and market conditions.

- Account for Expenses: Include fixed costs, variable costs, and potential unexpected expenses.

- Update Regularly: Revisit and revise forecasts as new information arises.

An accurate cash flow forecast provides clarity, helping to avoid potential cash flow shortages.

Strategies to Improve Cash Flow

Optimising Cash Inflows

- Incentivise Early Payments: Offer discounts to customers who pay promptly.

- Diversify Revenue Streams: Explore new markets or introduce complementary products.

- Improve Collections: Implement strict payment terms and follow up diligently on overdue invoices.

Reducing Cash Outflows

- Negotiate Vendor Terms: Extend payment periods to retain cash on hand.

- Control Operating Costs: Identify areas where expenses can be trimmed.

- Monitor Inventory Levels: Avoid overstocking to free up working capital.

These strategies ensure that businesses have enough cash available for critical needs.

The Role of a Cash Flow Statement

A cash flow statement tracks the inflow and outflow of cash over a specific period. This financial document is essential for:

- Evaluating liquidity.

- Identifying patterns in cash movement.

- Supporting cash flow management decisions.

Business owners should regularly review their cash flow statement to stay informed about their financial position.

Maintaining Healthy Cash Flow

To maintain a healthy cash flow, businesses must adopt disciplined practices and proactive management. Some essential steps include:

- Set a Budget: Clearly define spending limits and stick to them.

- Build Cash Reserves: Maintain a buffer to cover at least three months of operating costs.

- Monitor Regularly: Use real-time tools to track cash inflows and outflows.

- Streamline Operations: Invest in automation to reduce manual errors and inefficiencies.

These habits help businesses remain agile and resilient, even during periods of uncertainty.

Effective Cash Flow Management Practices

Implementing effective cash flow management practices involves:

- Regular Analysis: Conduct monthly reviews of financial data.

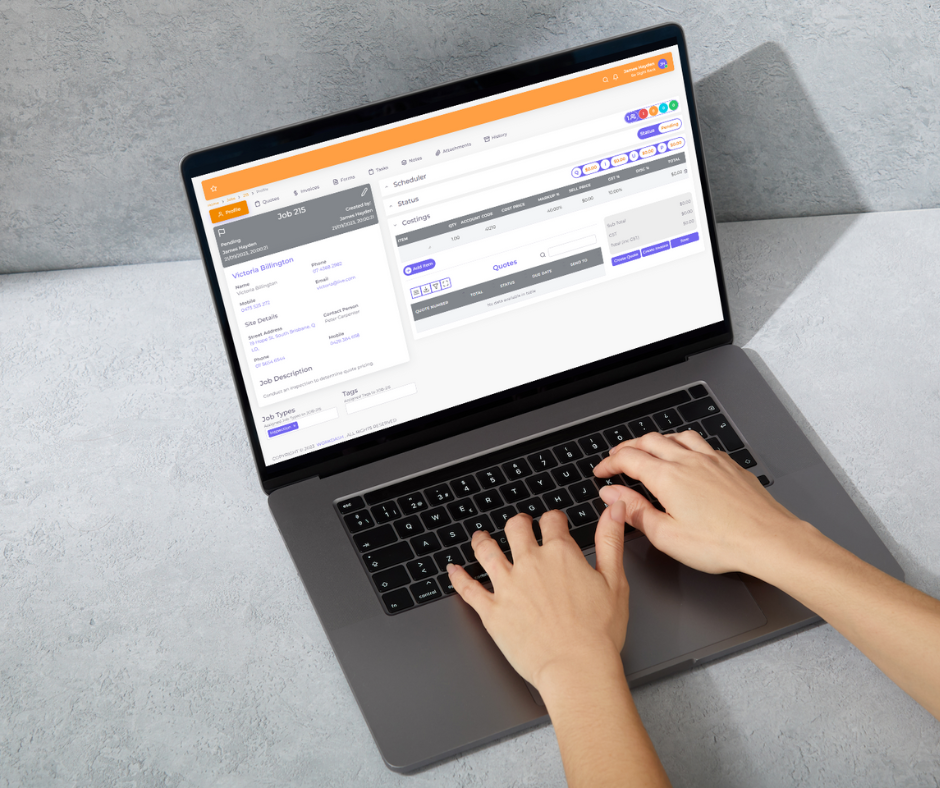

- Use Management Software: Leverage technology to track and forecast cash flow dynamics.

- Engage Financial Experts: Seek advice from accountants or consultants for optimising financial strategies.

By doing so, businesses can control their cash flow and avoid pitfalls.

Dealing with Negative Cash Flow

Periods of negative cash flow can occur due to external factors or poor planning. To navigate these situations:

- Cut Non-Essential Expenses: Reduce spending on non-critical items.

- Renegotiate Debts: Work with creditors to adjust repayment terms.

- Boost Revenues Quickly: Introduce flash sales or temporary promotions.

Addressing negative cash flow promptly prevents long-term financial damage.

Tools for Managing Cash Flow Effectively

Modern tools and technologies simplify cash flow management:

- Accounting Software: Automate tracking and generate reports.

- Cash Flow Dashboards: Gain real-time insights into financial metrics.

- Cloud-Based Solutions: Access financial data anytime, anywhere.

Investing in these resources ensures that businesses can effectively manage cash flow with accuracy and efficiency.

Cash Flow Strategies for Growth

For businesses looking to expand, it’s crucial to adopt cash flow strategies that align with growth goals. Strategies include:

- Reinvest Profits: Allocate surplus cash towards scalable opportunities.

- Secure Financing: Use loans or lines of credit to fund initiatives.

- Monitor Profit Margins: Maintain profitability to sustain growth efforts.

By planning strategically, businesses can ensure robust cash flow dynamics throughout expansion.

Improve Your Business Cash Flow

Improving your business cash flow involves a combination of foresight and action:

- Educate Teams: Train staff on the importance of maintaining positive cash positions.

- Communicate with Stakeholders: Keep open lines of communication with suppliers and customers.

- Stay Adaptable: Be prepared to adjust strategies as market conditions change.

These practices are essential for achieving better cash flow management and securing a healthy financial future.

Conclusion

Mastering cash flow management is an indispensable skill for any business owner. By adopting proactive practices, leveraging modern tools, and maintaining a disciplined approach, businesses can achieve healthy cash flow and long-term success. Whether you’re addressing cash flow problems or optimising processes for growth, the principles outlined in this guide will help you thrive in a competitive market.

Moreover, using a business management software like WorkDash can help you optimise processes, helping you have a healthy cashflow.