Table of Contents

A well-structured financial plan is the backbone of any successful business. Whether you’re a startup or an established enterprise, financial planning ensures that resources are allocated effectively, risks are mitigated, and cash flow is managed efficiently.

Businesses that implement strategic financial planning are more likely to achieve long-term success and sustain financial stability even in uncertain economic climates.

Research from the Harvard Business Review states that companies with strong financial planning processes outperform competitors by 30% in profitability. Similarly, a study by McKinsey & Company found that businesses with structured financial management experience higher growth rates and improved investor confidence.

In this guide, we’ll explore the importance of financial planning in business success and highlight key aspects such as goal setting, cash flow management, risk mitigation, and performance measurement.

Goal Setting and Clarity in Financial Planning

A financial plan is the foundation of any successful business. Without clearly defined financial goals, businesses may struggle with resource allocation, profitability, and long-term sustainability. The importance of financial planning lies in its ability to guide businesses toward measurable and realistic objectives, ensuring that financial resources are used effectively to drive growth and stability.

A robust financial plan aligns business activities with long-term success. It provides a structured approach to budgeting and forecasting, allowing businesses to anticipate financial challenges, make informed decisions, and maintain financial health.

Setting Clear Financial Goals

To ensure business success, financial goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Setting realistic financial objectives helps businesses maintain financial discipline while ensuring continuous growth. Key financial goals include:

Short-Term Goals

Managing cash flow effectively to cover operational expenses

Reducing unnecessary expenditures to increase profitability

Optimising the budget to enhance financial stability

Long-Term Goals

Expanding operations and entering new markets

Improving overall financial management and profitability

Strengthening financial reserves to sustain business continuity

Business financial planning involves identifying these objectives and implementing strategies to achieve them.

The Role of Financial Forecasting in Goal Setting

Financial forecasting plays a crucial role in setting realistic business goals. By analysing financial data and historical trends, businesses can predict future revenues, expenses, and investment needs.

A well-structured financial plan includes:

Revenue Forecasting – Estimating future income based on past performance and market conditions

Expense Forecasting – Identifying fixed and variable costs to maintain financial stability

Profitability Projections – Determining expected profit margins and return on investment

Using accurate financial reporting and financial planning and analysis, businesses can align their financial goals with market conditions, ensuring sustainable growth.

Resource Optimisation: Allocating Resources Effectively

One of the key functions of financial planning is ensuring optimal resource allocation. This involves distributing financial resources efficiently across departments while aligning with overall business objectives.

A well-structured budget allows businesses to:

Invest in growth opportunities without overspending

Optimise operational costs to increase profitability

Ensure financial sustainability even during market fluctuations

According to a report by PwC, businesses that effectively manage financial resources experience 20% higher efficiency in operations . This highlights the crucial role of financial planning in business success.

Cash Flow Management: The Lifeline of a Business

Poor cash flow management is one of the leading reasons why businesses fail. According to a study by the Australian Bureau of Statistics, over 40% of failed businesses cited cash flow issues as a primary cause.

Financial planning helps businesses:

Create accurate cash flow forecasts to anticipate financial needs

Monitor and control expenses to prevent cash shortages

Ensure timely payment of bills and employee salaries

A solid financial plan ensures businesses maintain liquidity, allowing them to operate smoothly and invest in growth.

Risk Management: Safeguarding Financial Stability

Every business faces financial risks—whether it’s economic downturns, market volatility, or unexpected expenses. Effective financial planning acts as a risk management strategy, allowing businesses to prepare for uncertainties.

Key aspects of financial risk management include:

Building emergency funds for unforeseen costs

Diversifying revenue streams to reduce dependency on a single source

Implementing insurance strategies to mitigate potential financial losses

According to Forbes, companies that incorporate risk management into their financial planning have a 40% higher chance of surviving economic downturns

Strategic Decision-Making with Financial Planning

A well-defined financial plan provides the data and insights needed to make informed business decisions. Instead of relying on guesswork, business owners can leverage financial reports, forecasts, and budget analyses to guide their strategies.

Effective financial decision-making includes:

Expanding into new markets based on financial feasibility

Scaling operations without overextending resources

Adjusting pricing models to maintain competitiveness

“Sound financial planning is the foundation of a successful business.” — Warren Buffett

With accurate financial reporting and budgeting and forecasting, businesses can confidently make strategic choices that align with their long-term success.

Fundraising and Investment: Attracting Investors with a Strong Financial Plan

Securing external funding is often necessary for business growth. Investors and lenders require a robust financial planthat demonstrates a company’s profitability, risk management, and long-term sustainability.

A strong financial plan enhances a business’s ability to:

Secure loans from banks and financial institutions

Attract investors by showcasing financial stability

Demonstrate projected returns on investment

A report from Deloitte states that businesses with a well-documented financial plan are 30% more likely to secure investor funding.

Performance Measurement: Tracking Financial Progress

A critical part of financial planning is continuously measuring financial performance. Businesses must track key performance indicators (KPIs) such as:

Revenue growth – Are sales increasing as expected?

Profit margins – Are costs being controlled effectively?

Return on investment (ROI) – Are business investments yielding profits?

By tracking these metrics, businesses can identify areas for improvement and adjust their financial strategyaccordingly.

Tax Planning: Reducing Liabilities and Maximising Savings

Financial planning isn’t just about managing income and expenses—it also includes effective tax planning. Businesses that proactively plan for taxes can:

Take advantage of tax deductions and credits

Reduce liabilities through strategic tax planning

Ensure compliance with Australian tax regulations

According to the Australian Taxation Office (ATO), businesses that engage in early tax planning save an average of 15-20% on their tax obligations

Conclusion: The Critical Role of Financial Planning in Business Success

A financial plan is not just a document—it’s a strategic tool that ensures business success by optimising resources, managing risks, and improving decision-making. Whether you’re a startup or a large enterprise, having a robust financial plan is essential for long-term sustainability.

By implementing effective financial planning, businesses can achieve:

Stronger financial stability

Optimised resource allocation

Improved cash flow management

Higher profitability and growth

“Failing to plan is planning to fail.” — Benjamin Franklin

Investing in financial planning today will ensure that your business is prepared for challenges, opportunities, and sustained business success in the future.

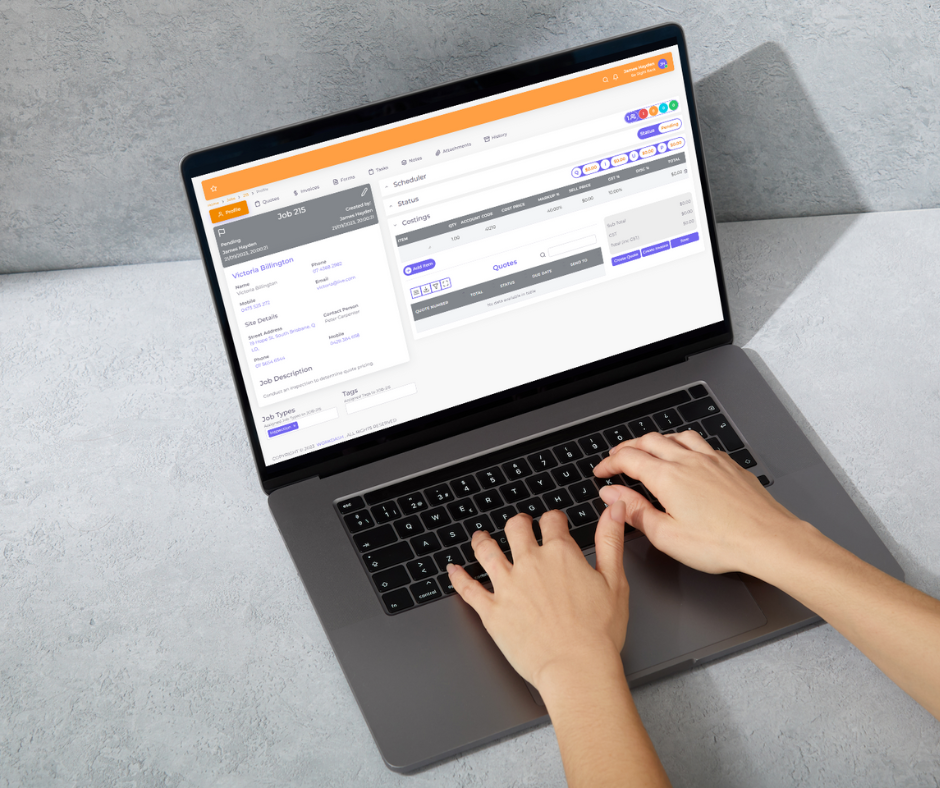

How Workdash Helps with Financial Planning

Managing a financial plan manually can be complex and time-consuming.

With Workdash, you can:

Automate financial reporting

- Optimise budget allocation to maximise profitability and business growth.

Manage accounting and payments seamlessly with integrated tools.