Table of Contents

A well-structured business budget is the backbone of financial stability for any small business. Without a clear budget plan, it’s easy to overspend, mismanage cash flow, or struggle with unexpected expenses. Whether you’re just starting out or refining your financial strategy, learning how to create a budget and stick to it will help you make informed business decisions and achieve long-term success.

In this guide, we’ll walk you through a step-by-step process to build a budget allocation that aligns with your business goals, helps track income and expenses, and ensures financial sustainability. Let’s dive in!

Gather Financial Basics

Before you can create a budget, you need a clear understanding of your current financial situation. This involves collecting essential financial documents and analysing past performance to identify trends.

Collect Key Financial Documents

To build an effective business budget, gather these important documents:

Balance sheet – Provides an overview of your business’s assets, liabilities, and equity.

Income statement – Shows your revenue, expenses, and profit over a specific period.

Cash flow statement – Tracks money coming in and out of your business, helping you allocate resources effectively.

By reviewing these documents, you’ll get a clearer picture of your financial health and be able to make strategic budgeting decisions.

Understand Your Current Financial Situation

Once you’ve gathered your financial statements, assess your business’s financial performance:

Look at past income and expenses to identify spending patterns.

Determine which expenses were necessary and which could have been reduced.

Identify seasonal trends or fluctuations in revenue.

Understanding these factors will help you forecast future income and expenses accurately, setting the foundation for a realistic budget plan.

Identify Potential Costs

A well-structured business budget accounts for every possible expense, ensuring there are no financial surprises. Identifying and categorising your costs allows for better budget allocation and helps you plan efficiently.

List Every Expense

Creating a detailed list of expenses is essential when you prepare a budget. Your costs may include:

Office rent

Utilities (electricity, internet, phone, water)

Employee salaries and benefits

Marketing and advertising costs

Software subscriptions and tools

Inventory and raw materials

Shipping and logistics

Even small expenses can add up, so tracking everything is key.

Categorise Costs

Once you’ve listed your expenses, categorise them for better financial planning:

Fixed Costs – These remain constant, such as rent, insurance, and payroll.

Variable Costs – These fluctuate based on business activity, like inventory purchases, sales commissions, and shipping fees.

Separating costs into categories helps you allocate resources efficiently and make informed business decisions.

Estimate Income

Now that you’ve identified your business expenses, it’s time to calculate your expected income. A well-estimated income projection ensures that your budget plan is realistic and aligns with your business goals.

Calculate Income

To get an accurate estimate of your business revenue, consider:

Sales revenue – The total income from selling products or services.

Investments – Any returns from business investments.

Other revenue streams – Additional income sources like rental income, licensing fees, or partnerships.

This step ensures your business budget reflects your actual income and expenses, helping you make informed financial decisions.

Revenue Forecasting

Predicting future business income involves:

Analysing historical sales data to spot trends.

Researching market conditions to anticipate fluctuations.

Factoring in seasonal changes that affect sales.

Considering the impact of new products or services.

Revenue forecasting is a crucial part of budgeting as it helps determine whether you need to adjust your budget allocation to maintain financial stability.

Create a Profit and Loss Statement

A profit and loss (P&L) statement provides an overview of your income and expenses, helping assess profitability. Key components include:

Total revenue – All income sources combined.

Total expenses – Fixed and variable costs.

Net profit or loss – Revenue minus expenses.

A clear P&L statement ensures your budget aligns with your financial goals and allows for better budget management.

Create a Budget Plan

With a clear understanding of your income and expenses, it’s time to put together a structured budget plan that helps you effectively allocate funds and track your business’s financial performance.

Develop a Budget Template

A well-organised budget template simplifies tracking and planning. You can create one using:

Spreadsheets (Excel, Google Sheets) – A flexible and customisable option.

Budgeting software (Xero, QuickBooks, MYOB) – Automates calculations and generates financial reports.

A structured budget spreadsheet helps you monitor actual income and expenses versus expected amounts.

Allocate Funds

Once you have a budget template, divide your financial resources wisely:

Prioritise essential expenses – Rent, salaries, and utilities should be covered first.

Set aside funds for growth – Invest in marketing, product development, and expansion.

Consider operational efficiency – Avoid unnecessary costs and streamline processes.

Effective budget allocation ensures your business runs smoothly and has room for growth.

Set Financial Goals

A budget plan isn’t just about managing costs; it’s also about setting goals. Define:

Short-term financial goals – Reducing costs, increasing profit margins, or improving cash flow.

Long-term financial goals – Business expansion, increasing market share, or launching new products.

Consider Revenue-Generating vs. Support Activities

To ensure profitability, direct more funds to revenue-generating activities such as:

Sales and marketing campaigns.

Product or service enhancements.

Customer acquisition and retention strategies.

While support activities (like admin tasks) are necessary, they shouldn’t consume most of your budget allocation.

Review and Adjust

Creating a business budget is just the beginning. To ensure long-term financial success, you must regularly review and adjust your budget plan to stay on track.

Regularly Review Your Budget

Monitoring your actual income and expenses against your budget allocation helps identify variances and adjust accordingly. Consider:

Monthly or quarterly reviews to track performance.

Comparing budgeted vs. actual results to spot discrepancies.

Reallocating resources to high-performing areas.

Frequent reviews ensure your budget aligns with your financial goals and business conditions.

Create a Contingency Fund

Unexpected expenses can arise, so it’s essential to set aside money for emergencies. Your contingency fund should cover:

Unforeseen operational costs (e.g., equipment repairs).

Economic downturns that impact revenue.

Unexpected business opportunities requiring extra investment.

Having a safety net prevents disruptions in your business budget.

Track Income and Spending

Use budgeting tools or software to track financial performance. Consistently monitoring:

Income sources ensures stable cash flow.

Expenses related to operations helps control overspending.

Financial statements provide insights into profitability.

By tracking your budget, you can make strategic adjustments and improve business performance.

Outline Your Future Business Budget

Planning for future growth requires forecasting expenses and allocating resources efficiently. Consider:

Expanding business operations and the associated costs.

Hiring new staff based on revenue projections.

Investing in new product development to stay competitive.

A forward-looking budget plan ensures your business remains financially sound and adaptable to market changes.

Conclusion

A well-structured business budget is essential for financial stability and growth. By carefully allocating funds, monitoring income and expenses, and making adjustments, you can ensure your business remains profitable and sustainable.

By following these steps—gathering financial data, identifying expenses, estimating income, creating a budget plan, and reviewing regularly—you’ll develop a budget management strategy that keeps your business on track.

Remember, budgeting is an ongoing process. Stay proactive, monitor financial statements, and adjust your budget allocation as needed to adapt to market changes and business growth. With a solid budget plan, you’ll make informed business decisions that lead to long-term success.

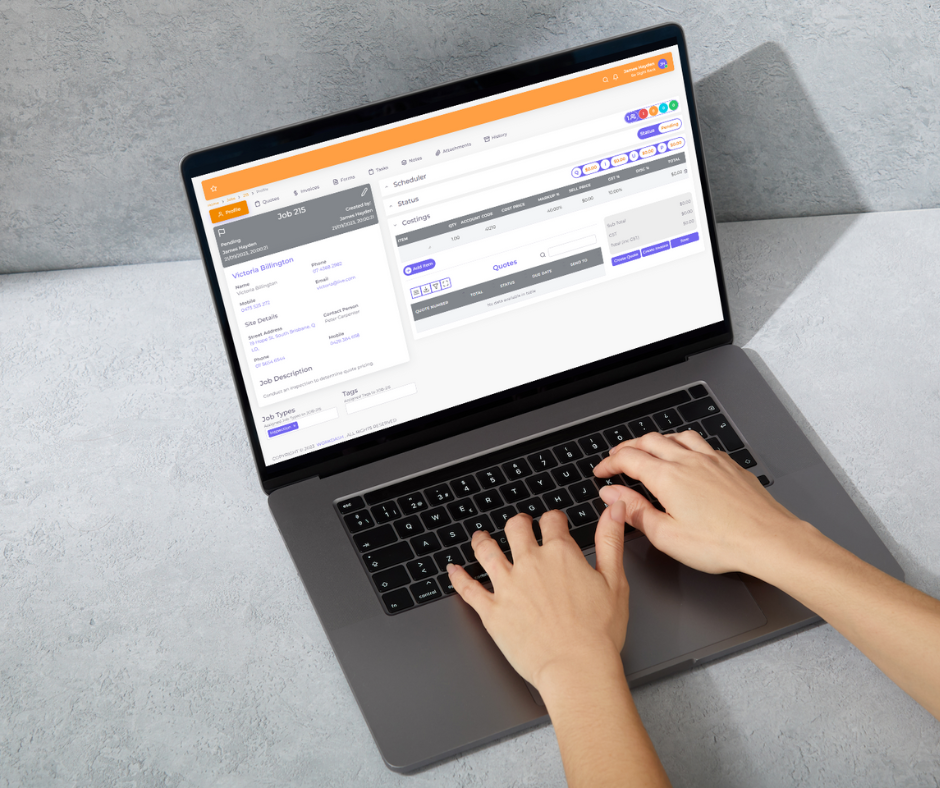

How Workdash Can Simplify Your Business Budgeting with Accounting & Payment Features

Sticking to a business budget is easier when you have the right tools. Workdash not only helps you create a budget plan, but it also offers accounting and payment features that streamline financial management.

Frequently Asked Questions

A business budget helps track income and expenses, ensuring financial stability. It allows you to allocate resources efficiently, plan for growth, and avoid cash flow issues.

Regular reviews—monthly or quarterly—are essential. Comparing your actual income and expenses with your budget helps you spot variances and make necessary adjustments.

Fixed costs remain constant, such as rent and salaries, while variable costs fluctuate, like inventory, shipping, and sales commissions. Understanding these helps with budget allocation.

Analyse historical data, track market trends, and consider seasonal fluctuations. Using a profit and loss statement and financial reports improves accuracy.

Monitor your spending, set financial goals, and create a contingency fund for unexpected expenses. Regular budget management and tracking ensure you stay on course.