Table of Contents

Accept Credit Card Payments Without the Pain: A Step-by-Step Guide for Small Businesses

Accepting card payment options is no longer optional for modern businesses. Customers expect to pay quickly, securely, and conveniently—whether that means tapping a phone, paying online, or using a card reader on-site. For a small business, the challenge isn’t whether to accept cards, but how to accept credit card payments without complexity, high fees, or operational headaches.

This guide for businesses breaks down everything you need to know about accepting credit cards, from choosing the right payment method to setting up online and in-person payments step by step. You’ll also see how WorkDash supports card payment workflows as part of a broader business management platform, helping businesses accept payments, track invoices, and manage the entire payment process—without ERP complexity.

Article Outline: Accepting Credit Card Payments Step by Step

1. Why Accepting Credit Cards Is Essential for Small Businesses

2. What Is a Card Payment and How Does the Payment Process Work?

3. What Are the Benefits of Accepting Credit Card Payments?

4. Ways to Accept Credit Card Payments: Online, In Person, and Phone

5. Credit Card Payments Online: How to Accept Payments Online

6. Credit Card Payments In Person and Over the Phone

7. Setting Up Credit Card Payments Step by Step

8. Payment Gateways, Processors, and Merchant Accounts Explained

9. Security, Compliance, and Card Payment Best Practices

10. How WorkDash Simplifies Card Payments for Small Businesses

Why Accepting Credit Cards Is Essential for Small Businesses

Accepting credit cards has become a baseline expectation for customers. A business that doesn’t accept card payments risks losing sales, slowing down transactions, and damaging customer trust. Whether customers are paying online or in person, credit card payment options provide speed, flexibility, and convenience.

For a small business, accepting credit cards also improves cash flow. Instead of waiting days for bank transfers or chasing invoices, businesses receive payments faster. Offering multiple payment options—including credit and debit card payments—helps businesses compete, grow, and meet customer expectations.

What Is a Card Payment and How Does the Payment Process Work?

A card payment occurs when a customer pays using a credit or debit card. Behind the scenes, the payment process involves several steps: capturing card details, authorising the transaction, processing the payment, and settling funds into the business account.

When a customer enters their card number or taps a card reader, the payment gateway securely sends the card details to the payment processor. The processor communicates with credit card networks and the customer’s bank before approving or declining the transaction. Understanding this process helps businesses choose the right setup and avoid unnecessary complexity.

What Are the Benefits of Accepting Credit Card Payments?

The benefits of accepting credit card payments go beyond convenience. Businesses that accept card payments often see higher transaction values, fewer abandoned purchases, and faster payments from customers.

Other benefits of accepting credit include improved customer experience, reduced cash handling, and better tracking of payments. For small businesses, credit card payment systems also integrate easily with invoicing, accounting software, and management systems—streamlining operations and improving visibility.

Ways to Accept Credit Card Payments: Online, In Person, and Phone

There are several ways to accept credit card payments depending on how your business operates. The most common options include online payments, card payments in person, and payments over the phone.

Some businesses rely primarily on payments online, while others need card payments for on-site work or retail environments. Many businesses choose a hybrid approach, enabling card payments online, in person, and over the phone to ensure they can accept payments anywhere customers are.

Credit Card Payments Online: How to Accept Payments Online

Credit card payments online are essential for modern businesses. To accept payments online, businesses need an online payment gateway connected to their website or invoicing system.

An online payment gateway securely processes card transactions and ensures customer card details are protected. Businesses can accept credit card payments online through invoices, payment links, or client portals—making it easy for customers to pay when and where they choose.

Credit Card Payments In Person and Over the Phone

Credit card payments in person typically require a card reader or credit card terminal. These devices allow businesses to accept cards via chip, swipe, or contactless payments.

For payments over the phone, businesses manually enter card details into a secure system. While this method is useful, it requires strict security controls to protect customer’s card details and comply with industry standards. Choosing the right tools ensures card payments over the phone are processed safely and efficiently.

Setting Up Credit Card Payments Step by Step

Setting up credit card payments doesn’t need to be complicated. The first step is choosing a payment provider that supports your business model. Next, decide whether you need a card reader, online payment gateway, or both.

Once selected, you’ll configure your payment method, connect it to your invoicing or management system, and test transactions. This step-by-step guide approach ensures you start accepting credit card payments smoothly and avoid common setup issues.

Payment Gateways, Processors, and Merchant Accounts Explained

Understanding the difference between a payment gateway, payment processor, and merchant account helps businesses make informed decisions. A payment gateway handles secure data transfer, while the processor manages transaction authorisation and settlement.

Some providers offer an all-in-one solution that removes the need for a separate merchant account. Others require a standalone merchant account. Choosing the right combination depends on transaction volume, fees, and how payments fit into your broader business operations.

Security, Compliance, and Card Payment Best Practices

Security is critical when processing credit card payments. Businesses must comply with the Payment Card Industry Data Security Standard, ensuring card details are handled securely.

Best practices include using secure gateways, avoiding storing card numbers directly, and enabling encryption. Following card industry data security standard guidelines protects both businesses and customers while building trust and reducing risk.

How WorkDash Simplifies Card Payments for Small Businesses

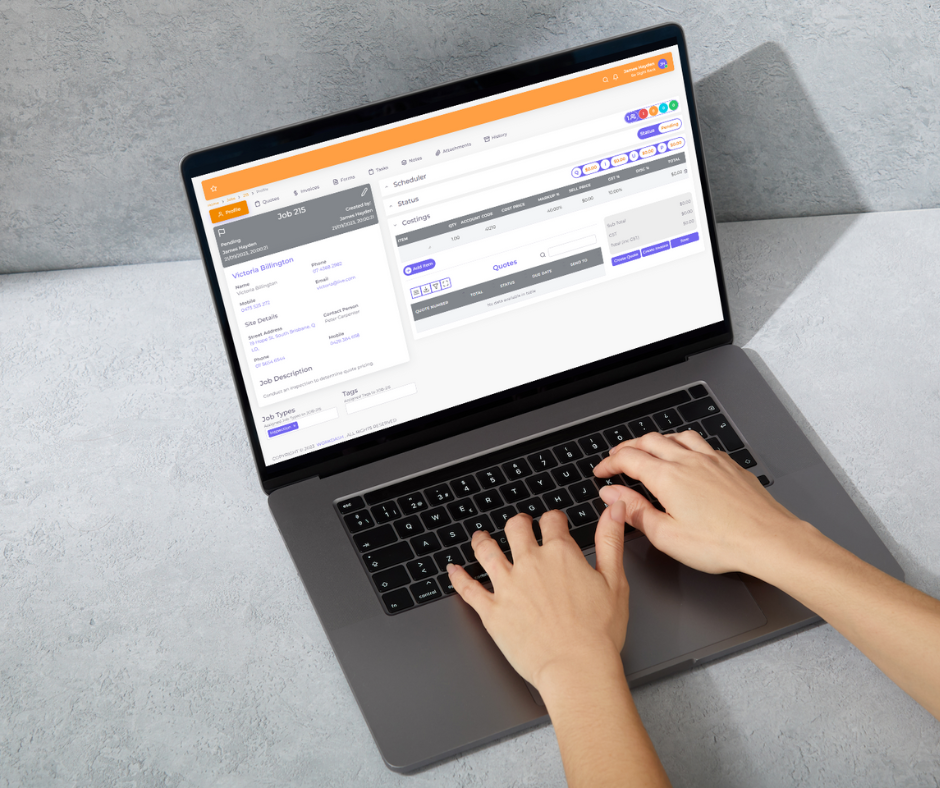

WorkDash supports card payment workflows as part of its business management platform. Businesses can issue invoices, accept payments online, and track credit card payment status without juggling multiple systems.

By integrating payments into everyday workflows, WorkDash helps small businesses accept credit card payments, manage billing, and improve cash flow—without ERP complexity. Payments become part of a streamlined payment process rather than a disconnected task.

Key Takeaways: Accept Credit Card Payments Without the Pain

Accepting credit cards is essential for modern small businesses

Card payment options improve customer experience and cash flow

Businesses can accept credit card payments online, in person, or by phone

Payment gateways and processors handle secure transactions

Setting up credit card payments can be simple with the right tools

Security and compliance protect customer card details

Offering multiple payment options increases conversion

Integrated payment systems reduce admin and errors

WorkDash connects card payments with invoicing and workflows

The right setup helps businesses accept payments confidently