Table of Contents

Starting a plumbing business is an exciting venture that offers opportunities for profitability and growth.

However, like any business, it requires careful financial planning to succeed. A comprehensive financial plan is vital for managing your plumbing business’s resources, optimising cash flow, and ensuring sustainable growth.

In this article, we will explore the key aspects of financial planning for plumbing businesses, covering everything from business plans and pricing strategies to expense management and profitability.

Key Aspects of Financial Planning for Plumbing Businesses

Financial planning is essential for the long-term success of any plumbing business. From managing cash flow and budgeting to preparing for tax obligations and growth investments, understanding the key aspects of financial planning helps plumbing business owners stay profitable, scalable, and resilient in a competitive market.

Business Plan: The Foundation of Your Plumbing Business

A plumbing business plan is essential for setting clear goals, outlining services, and establishing a direction for the future. It acts as a roadmap for your business, detailing every aspect from marketing strategies to financial projections. Without a solid business plan, it’s easy to lose sight of long-term objectives and to struggle with managing day-to-day operations.

A well-prepared business plan will provide clarity on your target market, define your value proposition, and help you set realistic goals. These could include increasing revenue, expanding your customer base, or even growing into new geographical regions.

Key components of a plumbing business plan include:

Executive Summary: A brief overview of your plumbing business, goals, and plans.

Market Analysis: Research into the plumbing market, competitors, and industry trends.

Services and Pricing: A clear outline of the services you offer and the pricing structure.

Financial Projections: A forecast of expected revenue, expenses, and profits.

Cash Flow Management: Maintaining Liquidity

Cash flow management is crucial for the day-to-day operation of a plumbing business. It involves tracking income and expenses to ensure you have enough liquidity to cover operating costs. Effective cash flow forecasting is key to preventing cash shortages, particularly during slow periods when revenue might dip.

Managing receivables and payables efficiently is also essential. If clients are slow to pay invoices, it can affect your ability to pay suppliers or meet other financial obligations. It’s important to maintain a clear invoicing process and ensure timely collections. Plumbing businesses can benefit from invoicing software that streamlines the process and reduces delays.

Cash flow management tips include:

Regularly reviewing accounts receivable and outstanding invoices.

Forecasting cash flow based on historical trends and seasonality.

Keeping a buffer of working capital for emergencies or unexpected expenses.

Pricing Strategy: Striking the Right Balance

Setting the right price for your plumbing services is a balancing act between competitiveness and profitability. Pricing strategies should reflect the value you provide while also covering costs and generating a profit. Undervaluing your services may lead to unsustainable operations, while overpricing could push customers towards competitors.

Key factors to consider in your pricing strategy include:

Cost of Goods Sold (COGS): This includes the cost of materials, tools, and labour required for each job.

Market Research: Understanding what competitors charge for similar services in your area.

Profit Margin: Determine the profit margin you need to sustain the business and grow. Plumbing services typically have gross margins between 30-50%, depending on the type of work (e.g., plumbing installation vs. maintenance).

Using tools like pricing software can help you automate calculations and ensure your prices remain competitive while still allowing for adequate profit.

Expense Management: Keeping Costs Under Control

Effective expense management is essential for maintaining profitability in the plumbing business. Costs can quickly spiral out of control if you don’t monitor and manage them closely. Common expenses include vehicle costs, fuel, insurance, and equipment maintenance. Keeping track of these operating costs is crucial to avoid eroding your profit margins.

Expense management tips for plumbing businesses include:

Regularly reviewing your operational costs and identifying areas where you can cut expenses.

Negotiating with suppliers to secure better pricing or favourable payment terms.

Using financial software to track expenses and get real-time updates on your business’s financial health.

Profitability: Maximising Earnings

Profitability is the ultimate goal of any plumbing business. Understanding your gross profit margin and continually seeking ways to optimise it is essential for long-term success. An increase in profitability can come from both increasing revenue and reducing unnecessary costs.

It’s important to analyse the profitability of each service you offer. For instance, a high-margin service like emergency plumbing may provide more profit than regular maintenance work. By identifying cost-saving opportunities, such as reducing material waste or improving the efficiency of your team, you can boost your overall profit margins.

Tips to maximise profitability:

Focus on high-margin services that offer higher profits for less effort.

Regularly assess and optimise your operational processes.

Track Key Performance Indicators (KPIs) to monitor profitability and identify areas for improvement.

Financial Projections: Planning for the Future

Financial projections are a crucial part of your plumbing business plan. Developing financial forecasts such as income statements, balance sheets, and cash flow statements can help you plan for future growth and avoid financial pitfalls. These projections provide a roadmap for expected revenue and expenses, allowing you to make informed decisions about your business’s future.

Essential financial projections for plumbing businesses include:

Income Statement: A summary of revenue, expenses, and profits over a specific period.

Balance Sheet: A snapshot of your business’s assets, liabilities, and equity.

Cash Flow Statement: A detailed look at cash coming in and out of your business.

Funding: Securing Financial Resources

Starting a plumbing business or expanding an existing one often requires capital investment. Securing funding is essential for covering startup costs, such as buying tools and vehicles, or for financing growth initiatives, like new construction projects or expanding your team.

Sources of funding for plumbing businesses may include:

Personal Savings: Using your own capital to finance the venture.

Loans: Applying for business loans or lines of credit.

Grants: Seeking government grants or other industry-specific funding options.

Seeking Professional Advice: Working with Experts

No matter how experienced you are, it’s always a good idea to seek professional advice when it comes to financial planning. Working with an accountant, bookkeeper, or financial advisor can provide valuable insights into managing your finances effectively. They can help you optimise your tax strategy, create financial projections, and ensure compliance with local regulations.

Benefits of professional advice:

Expertise in creating and managing a financial plan.

Assistance with tax planning and ensuring deductions are maximised.

Access to industry-specific insights and strategies for growth.

Practical Tips for Plumbing Business Owners

Invoicing and Collection: Streamlining Payments

Implementing an efficient invoicing process is critical to ensure timely payments and healthy cash flow. Utilise invoicing software that automates the process and tracks payments, reducing the risk of delayed payments and improving overall cash flow.

Budgeting and Forecasting: Plan Ahead

Using budgeting tools helps you plan for future expenses and forecast potential revenue. By understanding the financial landscape, you can better manage expenses, identify financial risks, and plan for the long term.

Supplier Management: Strengthening Relationships

Strong relationships with reliable suppliers can help you secure the best prices and terms, improving your overall cost structure. Negotiate with suppliers to reduce material costs and improve cash flow.

Technology Integration: Enhancing Efficiency

Integrating software solutions can automate accounting, billing, and financial reporting processes, freeing up time for other aspects of your business. Additionally, field service software can streamline job scheduling and customer management.

Networking and Partnerships: Expanding Your Reach

Networking with industry peers and building strong partnerships with contractors or other businesses can open doors to new customers and business opportunities. Referrals are often a key source of new work in the plumbing industry.

Continuous Improvement: Evaluating Financial Performance

Regularly reviewing your business’s financial performance is crucial to making informed decisions and adjusting strategies. By identifying areas for improvement and making necessary adjustments, you can ensure your business remains profitable and competitive in the plumbing market.

Conclusion

Financial planning is the backbone of a successful plumbing business. Whether you’re starting a plumbing business or looking to optimise an existing one, it’s essential to develop a comprehensive business plan that covers key areas such as cash flow management, pricing strategies, and profitability. By seeking professional advice and continually reviewing your financial performance, you can ensure long-term growth and profitability in the plumbing industry.

How WorkDash Business Management Software for Plumbers Can Help

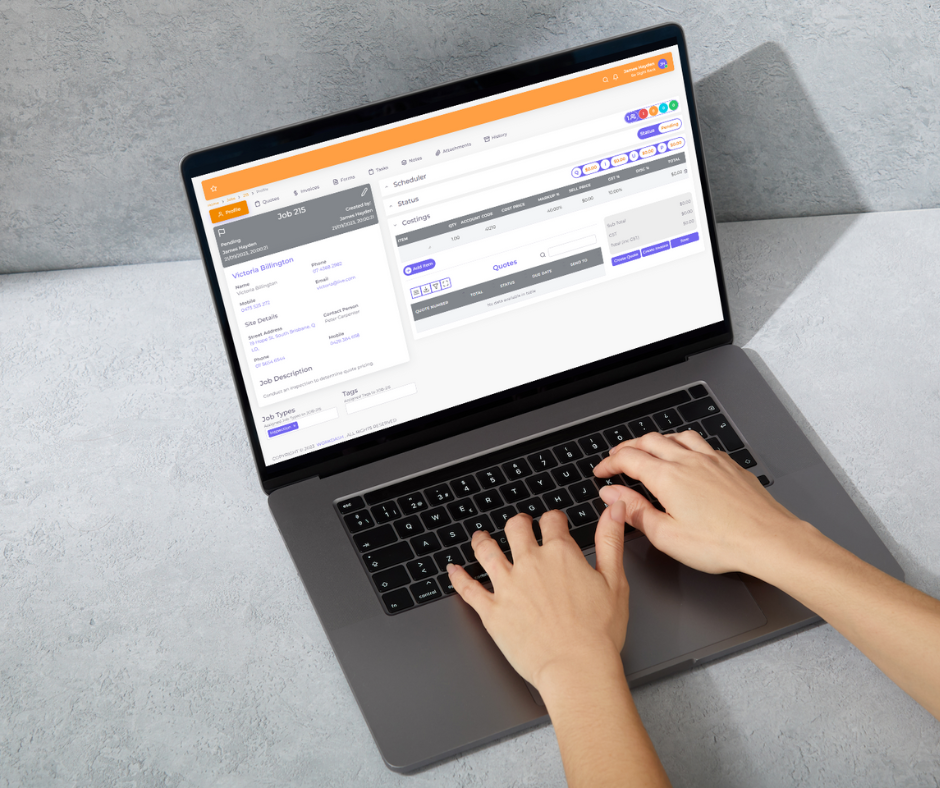

When managing a plumbing business, staying organised and efficient is key to maintaining profitability and streamlining operations. One tool that can significantly improve your business management is WorkDash, a business management software designed specifically for plumbers.

WorkDash provides a range of features that can help plumbers with day-to-day operations, including job scheduling, customer management, and financial tracking. By integrating these essential functions into one easy-to-use platform, plumbers can save time, reduce administrative overhead, and focus on what matters most—providing exceptional plumbing services to clients.

Streamlining Your Plumbing Business with WorkDash

By using WorkDash, you eliminate many of the manual processes associated with running a plumbing business. From job scheduling and customer management to financial tracking and invoicing, WorkDash integrates these functions into one seamless platform. This helps you stay organised, reduce errors, and improve efficiency—ultimately leading to a more profitable and successful plumbing business.