Table of Contents

Inventory, Cash Flow & Inventory Management: How Unified Data Drives Profitability (and Better Cash Flow Management, Inventory Turnover & Supply Chain Control)

Summary:

Inventory doesn’t just sit on shelves—it sits on your balance sheet. The way you buy, stage, issue, and bill stock can affect cash flow, margins, and growth capacity. In this practical guide for Australian SMEs, we unpack how unifying inventory, jobs, and billing data boosts profitability, shortens cash cycles, and reduces write-offs. You’ll see how WorkDash (the all-in-one ops platform at workdash.software) helps you connect inventory management with quoting, job costing, and invoicing—so you can make decisions with confidence and turn stock into cash, faster.

Article outline

Cash flow & inventory: why unifying operational data matters (and how it boosts profitability)

What is inventory management—and how do turnover, ratios, and supply chain signals fit together?

How does the supply chain affect cash flow for SMEs in Australia?

Which inventory management software features give you better inventory decisions and improve cash flow?

How to measure inventory turnover (and use the inventory turnover ratio & days of inventory to act)

Perpetual vs periodic inventory management: which inventory management system suits your stage?

Inventory optimization & control: methods, safety stock, JIT, and vendor-managed options

Cash flow management strategies tied to stock: from forecasting to freeing up cash

Planning with real-time data: from inventory planning to cash flow forecasts

WorkDash in action: unified jobs + inventory + invoicing to improve their cash flow (fast)

1) Cash flow & inventory: why unifying operational data matters

When operations and finance run on separate systems, blind spots grow. Procurement buys based on gut feel, techs over-issue on-site, and billing lags. The result is tight cash flow, stacked store rooms, and slow operating cash flow. Unifying job, stock, and billing data bridges those gaps so you can track inventory movements against revenue milestones and know exactly when cash lands.

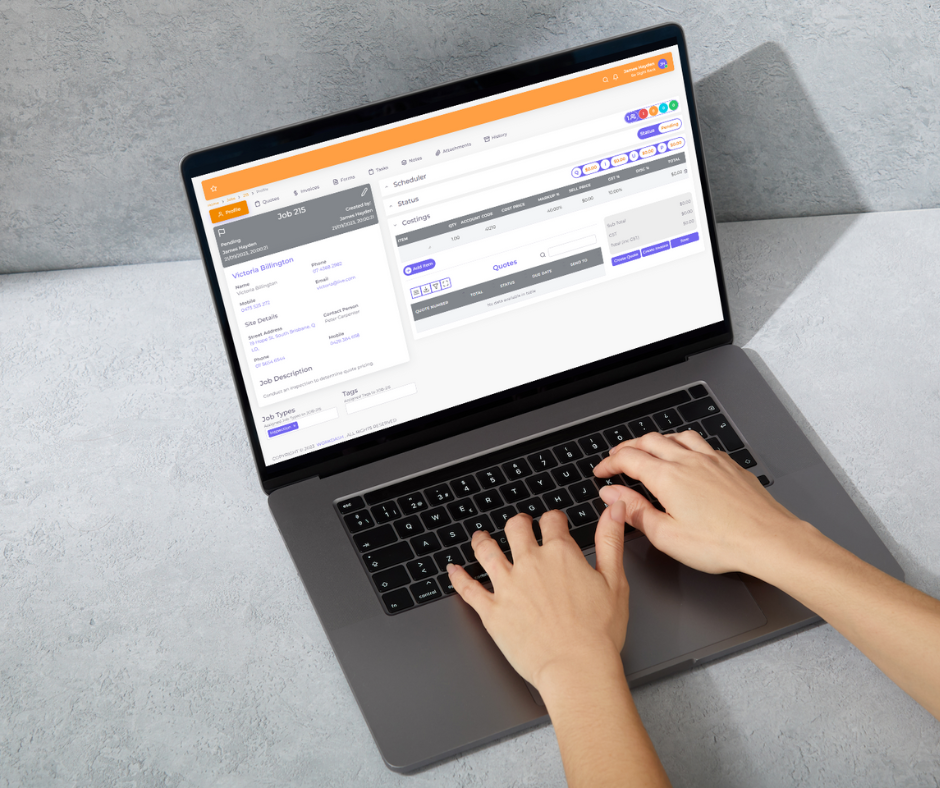

In WorkDash, every part, PO, and issue connects to a job and an invoice. That means the company’s cash flow view is grounded in inventory data, not estimates. Owners see inventory levels in context of scheduled work, expected delivery dates, and customer approvals—so decisions improve cash timing and reduce the cash outlay you carry.

2) What is inventory management—and how do turnover, ratios, and supply chain signals fit together?

Inventory management is the discipline of balancing service levels with the amount of inventory invested. At its core are three levers: how fast inventory is sold (velocity), how precisely you replenish (planning), and how tightly you link actions across the supply chain. Done well, inventory management directly influences profitability by lowering holding costs and making cash cycles faster.

Two foundational metrics guide decisions. First, inventory turnover shows how often inventory is sold and replaced within a period. Second, the inventory turnover ratio paired with average inventory and days of inventory reveals if you’re carrying a high level of inventory for demand. A high inventory turnover (and even a high inventory turnover ratio in certain categories) often signals strong demand matching—but too high can trigger stockouts. WorkDash brings these indicators into the same dashboard you use for jobs and billing, so planners can act instead of guess.

3) How does the supply chain affect cash flow for SMEs in Australia?

Your supply chain is a relay race: suppliers, shipments, receiving, stores, technicians, and customers. When one handoff slips, cash flow and inventory both suffer. Late deliveries increase inventory carrying costs (you buffer more “just in case”), while early or over-ordering leaves working capital tied up in inventory. With modern supply chain management, SMEs can see inbound and outbound changes quickly and adjust their inventory before costs spike.

WorkDash surfaces lead times and delivery statuses next to work schedules, so teams can optimize inventory against booked jobs—not just forecasts. That practical alignment reduces write-offs and improves cash on hand—because stock arrives when jobs are ready and inventory is sold into revenue quickly.

4) Which inventory management software features give you better inventory decisions and improve cash flow?

Not all inventory management software is equal. Look for inventory software that provides real-time data on on-hand counts, allocated stock, inventory in real-time movements, and job reservations. Your team needs to track inventory levels, mobile-scan at site, and see shortages before vans leave the depot. The right management software also connects usage to invoices automatically, reducing leakage.

WorkDash is built as an all-in-one management software layer for SMEs: purchase orders, receipting, issues, returns, and billing are tied to the same job record. That tight loop delivers the benefits of inventory management without spreadsheets—better inventory visibility, fewer stockouts, and faster billing that improves cash flow. It’s holistic inventory management you can deploy quickly.

5) How to measure inventory turnover (and use the inventory turnover ratio & days of inventory to act)

You can’t steer what you don’t measure. Start with average inventory (opening + closing / 2), then compute your inventory turnover ratio (COGS / average). Pair that with days of inventory (365 / turnover). These show whether your categories flow or stagnate. If turnover is low, investigate inventory management processes, pricing, or the type of inventory you’re carrying.

Use WorkDash to segment by job type, supply chain node, or inventory levels to help pinpoint where value stalls. For example, if slow-moving spares inflate inventory cost, shift to vendor-managed inventory on those lines. When turnover improves, future cash flows become more predictable—because stock velocity and invoicing cadence align.

6) Perpetual vs periodic inventory management: which system suits your stage?

A perpetual inventory system updates counts continuously as goods are received, issued, or returned. It gives accurate inventory at any moment and supports mobile scanning—ideal for field service and construction. Periodic inventory management updates less frequently (e.g., monthly), which can be simpler but risks surprises and write-offs if usage is high or dispersed.

WorkDash supports perpetual flows by default while making cycle counts painless. You can still perform a monthly true-up, but day-to-day action uses live data. For SMEs shifting from periodic to perpetual, this change unlocks effective inventory decisions, optimal inventory levels, and management strategies that lower waste.

7) Inventory optimization & control: methods, safety stock, JIT, and vendor-managed options

Inventory control starts with choosing the right inventory control methods for each category: min-max, reorder point, EOQ, and ABC policies. Layer inventory optimization with demand seasonality, supplier reliability, and job schedules. In fast-moving lines, just-in-time inventory or just-in-time inventory management reduces the capital tied up in inventory; in long-lead items, buffers protect service levels.

Where partners are strong, vendor-managed inventory shifts planning upstream and can reduce the risk of inventory obsolescence. In WorkDash, rules and alerts help manage inventory by location and job so planners keep the right inventory at the right place. This approach to inventory management blends policy with reality—technicians and supervisors receive guidance, not complexity.

8) Cash flow management strategies tied to stock: from forecasting to freeing up cash

Great cash flow management treats inventory like a lever, not a fixed cost. Use cash flow strategies and strategies to improve cash flow that blend ordering rhythm, supplier terms, and billing cadence. For example, issue partial invoices on milestone completion, not only at final handover; align receipts to scheduled jobs; and convert slow-moving stock into kits that sell. These tactics increase free cash flow without starving teams of parts.

WorkDash links inventory events to billing triggers, which helps owners forecast future cash and produce cash flow forecasts grounded in work-in-progress. As you tune policies, you’ll see working capital and cash flow improve—simply by reducing excess inventory and tightening the gap between purchasing and invoicing. That’s freeing up cash you can reinvest in growth.

9) Planning with real-time data: from inventory planning to cash flow forecasts

Inventory planning works when planners and dispatchers share the same facts. With WorkDash, planners see booked jobs, reserved parts, and inbound deliveries in one place. That real-time data makes cash flow planning credible because it’s tied to actual schedules, not static spreadsheets. Leaders can run cash flow and inventory scenarios and export board-ready views in minutes.

As demand shifts, teams quickly adjust their inventory policies—raising or lowering reorder points and switching suppliers. Because planning, jobs, and finance share a spine, future cash visibility improves and management plays (like promotions to move dead stock) are easier to execute.

10) WorkDash in action: unified jobs + inventory + invoicing to improve their cash flow (fast)

Here’s an example of inventory and job data in sync. A maintenance firm receives an urgent HVAC project. Using WorkDash, they reserve parts to the job, trigger purchasing for gaps, and schedule crews. As tasks complete, techs issue parts via mobile, and the system auto-builds billable lines. Finance raises the invoice the same day. The benefits of inventory visibility are immediate: faster billing, fewer callbacks, and clear business value from stock decisions.

To keep momentum, the team publishes an inventory management plan with common inventory management rules for fast-movers and a policy for excess inventory ties (convert to service kits). Over the first quarter, they see lower inventory cost, reduced write-offs, and steadier cash flow—proof that good inventory management + unified jobs = better margins.

Practical toolkit: methods & terms you can put to work today

Inventory management techniques: ABC analysis, EOQ, reorder points, safety stock, cycle counting.

Inventory management methods: min-max, Kanban, consignment, vendor-managed inventory.

Inventory management practices that work: issue to job only, mobile scan, same-day receipts, weekly variance checks.

Inventory management software systems checklist: live counts, allocations, reservations, kit BOMs, barcode support, returns, and ledger integration.

When it comes to inventory visibility, make it easy for crews to keep track of inventory on site.

Use an inventory management system that ties parts to tasks so you manage their inventory in context of work.

Remember: poor inventory management hides in the handoffs. Tighten the inventory management processes and watch profitability rise.

The “red flag” list: avoid these traps

Poor inventory visibility between warehouse and vans creates double buys and delays.

Ignoring inventory planning leads to random purchases and spiking inventory carrying costs.

Missing mobile issues breaks the link between usage and invoice, starving cash flow.

Not segmenting type of inventory (fast/slow/critical) inflates the buffer everywhere.

Skipping forecasting makes cash flow forecasts guesswork—and finance can’t forecast future cash.

Why WorkDash for Australian SMEs?

WorkDash connects inventory, jobs, scheduling, and billing so every movement has a purpose. You get live counts, reservations, POs, GRNs, and returns tied to tasks, with technicians issuing parts on a mobile app. Finance sees the same truth, so cash flow and stock decisions align. It’s a guide to inventory that lives inside your day-to-day work—no extra tool hopping. If you need help with inventory, WorkDash’s team can stand up policies and dashboards quickly, so you can focus on service, not spreadsheets.

Ready to take control of inventory and get your cash moving faster? WorkDash gives you practical tools to optimize inventory and accelerate billing—without slowing your teams.

Bullet-point summary: what to remember

Inventory management isn’t about counting; it’s about converting stock to cash quickly and safely.

Use turnover metrics: inventory turnover, inventory turnover ratio, average inventory, and days of inventory to guide action.

Choose a perpetual inventory management system for accurate inventory and live decisions; use periodic inventory management only where risk is low.

Apply fit-for-purpose inventory control methods (e.g., JIT, vendor-managed inventory) to reduce the capital tied up in inventory.

Treat stock as a cash lever: align purchasing, issuing, and invoicing to boost cash flow and profitability.

Build cash flow forecasts from job and stock realities, not spreadsheets—so you can improve cash flow with confidence.

Reduce inventory cost and inventory carrying costs by segmenting SKUs, setting optimal inventory levels, and enforcing mobile issues.

Combine planning with real-time data to make cash flow planning credible and to adjust their inventory policies fast.

Beware poor inventory management at handoffs; fix the inventory management processes and management practices that cause leakage.

WorkDash unifies jobs, inventory, and billing for Australian SMEs—so you can manage inventory, strengthen cash flow management, and drive durable profitability.