Table of Contents

Invoice to Cash in One Flow: Streamline CRM, Billing, and Job Management with an Automated Invoicing System (the CRM with Invoicing approach in One Platform)

Summary:

When leads, jobs, and billing live in different tools, cash stalls and mistakes multiply. This guide shows how to connect a modern CRM to job management and billing so you can automate quoting, time, materials, and invoice creation in one flow. You’ll learn exactly which steps to standardise, what to integrate, and how WorkDash (workdash.software) turns lead-to-invoice into a repeatable engine that improves cash flow, shortens cycles, and gives teams fewer clicks and more clarity.

Outline

Why link invoice, CRM and billing? (the end-to-end workflow that unlocks cash)

What does a modern CRM with Invoicing look like? (capabilities and the CRM system spine)

From lead to job to invoice: a practical invoicing workflow (quotes, jobs, and invoice generation)

Automate your billing process: rules, reminders, and recurring billing

How to integrate with accounting software and a clean payment process

Keep data accurate: sync and invoice data integrity in one system

How to choose the right tools: job management software, CRM software, and management software

When you need invoicing depth: invoicing system vs invoicing solution vs specialized invoicing software

Metrics that move money: KPIs to improve cash flow and reduce unpaid invoices

WorkDash in action: lead-to-invoice in one platform—from sales management to order management to project completion

1) Why link invoice, CRM and billing? (the end-to-end workflow that unlocks cash)

When sales works in one app, dispatch in another, and billing in a third, the hand-offs break. Teams re-key invoice lines, lose attachments, and miss billable items. A unified lead-to-invoice workflow eliminates those gaps: the accepted quote becomes the job; time and parts post automatically; the invoice is generated with a click and sent the same day. This streamlined path transforms speed and accuracy, which directly improves cash flow for your business.

On WorkDash, the job’s labour and materials flow into invoice creation automatically. Supervisors can create an invoice from a job card, attach photos and project information, and push to the ledger with integrated journals. The billing process reduces time and cost by removing duplicate data entry and giving managers clean visibility into every step.

2) What does a modern CRM with Invoicing look like? (capabilities and the CRM system spine)

A modern CRM is more than a rolodex; it’s a crm platform that captures customer relationship management history, quotes, approvals, and hand-offs to delivery. A great CRM with invoicing keeps the invoicing process close to the customer context, so sales and delivery see the same truth. Think opportunities that convert to quotes, quotes and invoices tied to jobs, and automatic tax/price rules that help businesses stay consistent.

Within the CRM system, you should also see job state, invoice status, and reminder tasks. That way, reps know when to follow up on outstanding invoices, service teams know what’s approved, and finance trusts the numbers. On WorkDash, this spine connects leads → quotes → jobs → invoice management without exporting lists or juggling tabs—management and billing meets management and invoicing in one place.

3) From lead to job to invoice: a practical invoicing workflow (quotes, jobs, and invoice generation)

Start with consistent templates. A standard quote layout and invoice template ensure item codes, tax, and units match what your accounting software expects. Convert the accepted quote to a job; assign crews; capture time and materials during the job; and trigger invoice generation when milestones are reached. If you run project management, align job and project tasks to billing events so nothing slips.

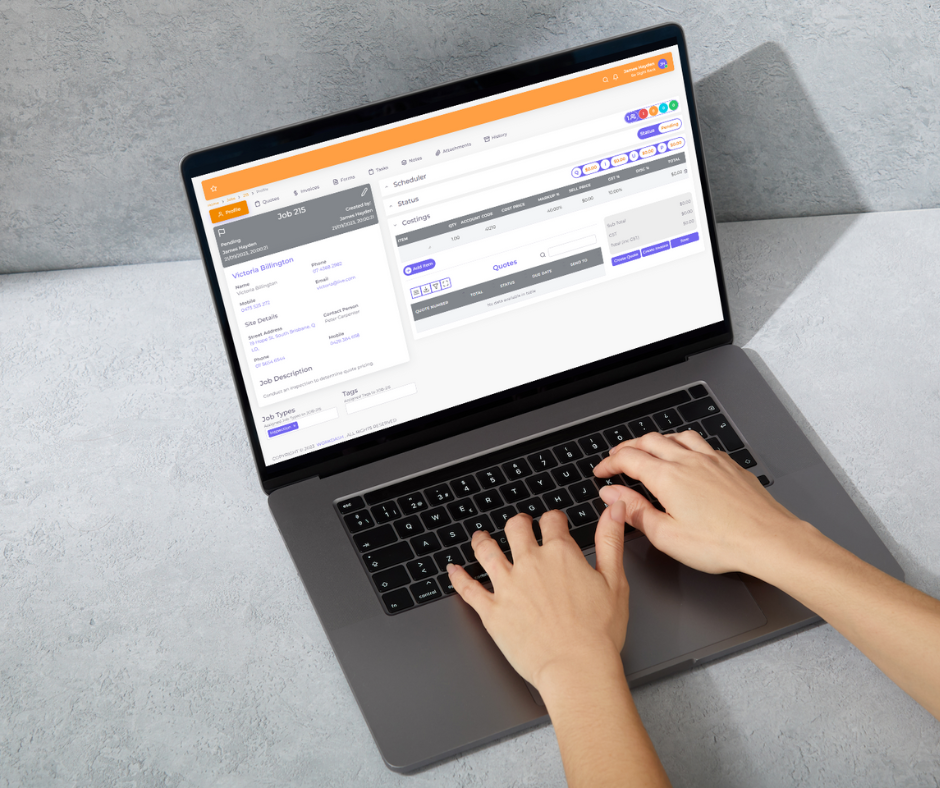

In WorkDash, the quote fuels scheduling and job tracking. Techs add parts and time; approvals trigger invoice creation; and finance verifies totals before posting to the ledger. This “single spine” streamlines the steps using a CRM at the top and operational detail beneath, so quotes and invoices always match what was delivered on-site.

4) Automate your billing process: rules, reminders, and recurring billing

Codify billing rules once and let the platform execute them. Deposit on acceptance, progress claims at 40/40/20, T&M with rounding, or flat fee on project completion—the system should automate billing so teams stop doing math in spreadsheets. For services on retainers or scheduled maintenance, set recurring billing cycles so automated invoicing lands on time without manual touches.

Don’t forget follow-ups. A structured reminder ladder nudges customers to pay: friendly prompt at 7 days, firmer at 14, final at 30—each including secure payment links directly on the invoice. In WorkDash, these touches help maintain a consistent billing experience while reducing staff workload; automated tasks help to streamline collection without awkward phone calls.

5) How to integrate with accounting software and a clean payment process

Lead-to-invoice only works if finance stays aligned. A real-time integrateion to your accounting software keeps customers, items, tax codes, and journals consistent. The payment process should be simple—cards, bank, or buy-now-pay-later options—so you send invoices and get paid quickly. WorkDash posts invoices and payments back to the ledger, preserving audit trails and financial management clarity.

This alignment also supports cash flow management. When jobs close and invoices post immediately, you can forecast receivables more accurately and schedule purchases with confidence. The result is better cash flow timing and fewer end-of-month scrambles.

6) Keep data accurate: sync and invoice data integrity in one system

Great invoicing systems help by eliminating double entry. Your CRM, jobs, and invoicing software should sync customers, items, and taxes continuously. That reduce manual corrections and ensures accurate billing. If a part changes price, or a tax rule updates, one system should handle it—so teams don’t maintain conflicting lists.

WorkDash locks in the job’s scope, then pulls actuals into the invoice. Attachments, photos, and approvals travel with the invoice data, so what finance sees is what field delivered. That’s how an all-in-one invoicing solution protects margins while protecting your time.

7) How to choose the right tools: job management software, CRM software, and management software

Choosing tools isn’t about brand; it’s about fit. Choose the right job management software and CRM software that share a data spine—ideally the same management software—so hand-offs vanish. Look for a management tool with strong invoicing capabilities, file attachments, role permissions, and “click-to-bill” from jobs. Fewer systems means fewer gaps and faster training.

WorkDash is software that automates the steps you run daily—lead capture, quoting, scheduling, materials, time, and invoice—so teams work in context. Because it’s the same place you schedule crews, “create & track invoice” becomes muscle memory, not an extra chore.

8) When you need invoicing depth: invoicing system vs invoicing solution vs specialized invoicing software

Some businesses have billing needs that go beyond basics—usage-based charges, multi-entity rollups, or complex billing with surcharges and rebates. Others run high invoice volumes with hundreds of small tickets per day. In those cases, a more flexible billing engine or specialized invoicing software can be justified.

The good news: WorkDash covers the majority of SME scenarios with a robust billing tool—progress claims, T&M, retainers, and recurring billing—while staying simple. If you truly outgrow it, APIs let you pair WorkDash with a niche billing engine without losing your unified job flow. Either way, your invoicing systems help keep the entire billing picture coherent.

9) Metrics that move money: KPIs to improve cash flow and reduce unpaid invoices

Track what matters: days-to-bill from job finish, days-sales-outstanding, first-time-right invoice rate, and unpaid invoices aging. Use “approved-not-billed” and “outstanding invoices by owner” dashboards to prioritise collections. These insights help you make informed decisions about staffing and stock, and they improve cash flow by tackling bottlenecks first.

In WorkDash, collections lists and reminder schedules surface late payers automatically. Notes live within the CRM system, so sales and billing stay aligned and customer conversations stay human. Over time, better process adherence + rapid invoice creation becomes a structural advantage—not just a month-end push.

10) WorkDash in action: lead-to-invoice in one platform—from sales management to order management to project completion

Here’s how it works in practice. Marketing creates a lead; the rep qualifies it using a CRM view; a quote is issued from a product list; the client accepts; the job is scheduled. Field staff complete tasks; costs and time flow to the job; approvals trigger invoice creation; finance pushes to the ledger; and the collection flow begins. All of this happens in one platform with native crm integration, so the invoicing workflow is almost invisible—just the way it should be.

Because WorkDash also handles order management and light supply chain management, item availability appears during quoting and scheduling. That keeps promises realistic and makes billing in one motion—quote to invoice—a daily habit. From first touch to project management close-out, WorkDash’s invoicing features ensure invoicing ensures nothing billable is left behind on every job.

Practical checklist: features to look for in an end-to-end invoicing solution

Quote → Job → Invoice conversion with item, labour, and tax continuity

Photo/approval capture that lands directly on the invoice

Automated invoicing for deposits, progress claims, and recurring billing

Reminder cadences and payment links that nudge customers to pay

Strong crm integration so invoice state is visible to sales

Clean integrateion to accounting software for journals and reconciliation

Mobile job capture; one-click create invoices from field data

Role-based approvals to protect revenue and reduce credits

Templates: quote and invoice template libraries for brand and compliance

Analytics: “ready to bill today,” aging, and DSO—to improve cash predictably

Micro-scenarios (so you know it’s real)

Recurring maintenance: Set up a contract; schedule visits; capture labour/parts; run recurring billing cycles automatically each month; deposits and finals handled by automated rules.

T&M emergency callout: Create job from the CRM; field tech logs time/parts; invoice lands the same day; card link in the email so the customer can pay immediately.

Project milestones: Quote with stages; approvals become jobs; billing and invoicing triggered as tasks hit 25/50/100%; finance checks and posts. The billing process is controlled and auditable.

Buyer guidance: choose software with fast time-to-cash

You don’t just “find invoicing apps” and hope. Choose the right CRM plus job management that can integrate cleanly, automate repeats, and keep the team in flow. Evaluate invoicing capabilities by building a test quote, converting to a job, capturing a change, and raising an invoice—all in under 10 minutes. If you can’t, you’ll struggle in production.

WorkDash is designed as software that automates those exact moments. It’s a billing solution that’s invisible to users: they just finish work and create invoices without leaving the job screen. That’s how help businesses scale without adding back-office headcount.

Edge considerations and governance

Manual invoice exceptions: if a job needs custom wording, allow an override—but track it.

Invoice management locks: prevent edits after posting; revision history protects compliance.

Financial management controls: separate permissions for pricing, posting, and refunds.

Flexible billing: mix fixed-fee, T&M, and retainers in one customer account when contracts demand it.

Invoicing systems help deliver governance while staying usable—get both.

Bullet-point summary — what to remember

Connect lead → quote → job → invoice so teams streamline work and accelerate cash flow.

Use a CRM with invoicing so sales sees billing state and finance sees customer context.

Standardise your invoicing workflow with templates, rules, and milestone-based invoice generation.

Automate billing with deposits, progress claims, and recurring billing; add reminder ladders and payment links.

Integrate with accounting software so journals reconcile and the payment process is painless.

Keep invoice data clean with live sync—one spine, one system, fewer errors, more accurate billing.

Choose the right job management software and CRM software—preferably the same management software—to reduce clicks.

If you truly need invoicing depth (usage pricing, high invoice volumes, or complex billing), pair your job flow with specialized invoicing software.

Track DSO, aging, days-to-bill, and first-time-right: these insights help you make informed decisions that lift cash flow.

WorkDash unifies crm, job management, and billing in one—giving you one platform where invoicing systems help teams execute, create invoices, and get paid faster.