Table of Contents

In today’s fast-paced business environment, operational risks are inevitable. From technology failures to human errors, businesses face numerous challenges that can lead to financial losses, reputational damage, and regulatory penalties. This is where operational risk management plays a critical role.

Operational risk management is the process of identifying, assessing, and mitigating risks that arise from inadequate or failed internal processes, people, systems, or external events. A strong risk management framework This approach ensures businesses can handle uncertainties effectively, maintain compliance, and mitigate the risk of loss resulting from operational disruptions.

In this article, we’ll explore the different types of operational risks, best practices for risk assessment, and strategies for an effective operational risk management framework. Whether you’re a risk manager, a business owner, or a financial professional, understanding and implementing these risk strategies is essential for long-term success.

Understanding Operational Risk Management

Operational risk management is an essential discipline in modern business, ensuring organisations can effectively anticipate, assess, and control risks that might disrupt operations. Unlike financial risks, which are directly tied to market fluctuations, operational risks stem from internal processes, people, and systems. Managing these risks proactively is crucial for minimising financial losses, reputational damage, and regulatory non-compliance.

Key Components of Operational Risk Management

Operational risk management involves a structured approach that includes:

Risk Identification: Recognising potential risks that could impact business functions, such as system failures, fraud, or human errors.

Risk Assessment: Evaluating the risk of loss by analysing the likelihood and severity of operational failures.

Risk Control: Implementing measures to reduce or eliminate identified risks, including process improvements and technology upgrades.

Monitoring and Reporting: Continuously tracking risk exposure and reporting critical risk events to senior management.

Response and Mitigation: Developing contingency plans to manage risk events effectively when they occur.

The Role of Operational Risk Management in Business

A well-defined operational risk management framework benefits organisations by:

Reducing technology risk and operational failures.

Enhancing decision-making through risk assessment and data analysis.

Strengthening compliance with legal and regulatory requirements.

Minimising financial losses through effective risk control measures.

For financial institutions, operational risk management is particularly crucial, as it helps protect against fraud, cyber threats, and system failures that could disrupt banking services. By integrating strong operational risk management practices, businesses across industries can ensure sustainability and resilience in an unpredictable world.

ypes of Operational Risks and Their Impact

Operational risks can arise from multiple sources, affecting businesses in different ways. Understanding the types of operational risks is essential for developing an effective operational risk management strategy.

Categories of Operational Risks

Technology Risk – System failures, cyber-attacks, and IT infrastructure issues that disrupt business operations.

Employee Risk – Human errors, misconduct, and lack of proper training that lead to financial and reputational damages.

Market Risk – External economic factors that affect operations, such as regulatory changes and supply chain disruptions.

Process Failures – Inefficiencies in workflows and compliance breaches that cause operational disruptions.

Fraud and Security Risks – Financial fraud, insider threats, and data breaches that compromise business integrity.

Examples of Operational Failures

Real-world examples show the consequences of poor risk management practices:

Technology risk: A major bank suffered losses when a server failure shut down online banking services for 24 hours.

Employee risk: A financial institution faced heavy fines due to compliance breaches caused by untrained staff.

Market risk: A logistics company struggled with supply chain delays after unexpected global trade restrictions.

Impact on Businesses

Failing to manage operational risk can lead to:

Financial losses due to fraud, fines, or operational disruptions.

Reputational damage, reducing customer trust and brand credibility.

Regulatory penalties, leading to legal challenges and stricter compliance measures.

A strong operational risk management approach ensures businesses mitigate these risks effectively, safeguarding their long-term success.

Effective Operational Risk Management Strategies

To manage operational risk effectively, businesses must adopt a structured approach that includes risk assessment, monitoring, and mitigation strategies. Here are key practices to enhance operational risk management.

1. Implementing a Risk Assessment Process

A thorough risk assessment process is crucial for identifying potential threats. This involves:

Risk Identification – Recognising vulnerabilities in business operations, technology, and human factors.

Risk Analysis – Determining the likelihood and impact of each type of risk.

Risk Prioritisation – Using a risk assessment matrix to classify risks based on severity and urgency.

2. Strengthening Risk Control Measures

Effective risk and control mechanisms prevent operational failures. These include:

Technology Upgrades – Reducing technology risk by investing in cybersecurity, automated monitoring, and system backups.

Employee Training – Addressing employee risk through regular training on compliance and operational procedures.

Process Improvement – Enhancing workflows to minimise inefficiencies and human errors.

3. Using Key Risk Indicators (KRIs) for Monitoring

KRIs help businesses measure risk exposure and take proactive action. Common KRIs include:

Transaction Errors – Frequent errors in financial transactions indicate a risk of loss.

System Downtime – A high number of IT failures signals a need for stronger risk controls.

Compliance Violations – Increased regulatory breaches highlight gaps in risk management efforts.

4. Developing a Risk Mitigation Plan

A risk mitigation plan ensures quick responses to operational failures. This includes:

Crisis Management Protocols – Establishing action plans for risk events like system outages or fraud incidents.

Business Continuity Strategies – Ensuring alternative workflows to maintain operations during disruptions.

Regular Audits – Assessing risk management effectiveness and making necessary improvements.

By integrating these strategies, organisations can build a strong operational risk management framework that reduces financial losses, strengthens compliance, and enhances business resilience.

Operational Risk Management Process: Steps to Success

A structured operational risk management process ensures organisations can effectively identify, assess, and mitigate risks. This process involves several key steps.

1. Risk Identification

The first step in the management of operational risk is to identify potential threats that could disrupt business operations. This includes:

Sources of risk, such as technology failures, fraud, or human errors.

Risk events, including cybersecurity breaches or regulatory non-compliance.

Reporting of operational risks to senior management for immediate action.

2. Risk Assessment and Measurement

A thorough risk assessment process helps quantify the level of risk associated with each potential issue. Tools used for this include:

Risk assessment matrix – Categorising risks based on impact and probability.

Operational risk profile – A snapshot of an organisation’s current risk exposure.

Key risk indicators (KRIs) – Data-driven measures that track risk levels over time.

3. Risk Control and Mitigation

To mitigate operational risks, businesses must implement risk management practices such as:

Controlling the risk by improving internal processes.

Mitigating operational risks through technology upgrades and stronger compliance policies.

Developing an operational risk management program that aligns with the company’s risk appetite.

4. Continuous Monitoring and Improvement

The state of operational risk management evolves, requiring ongoing risk management efforts. This includes:

Risk reporting to senior management for informed decision-making.

Oversight of operational risk through real-time monitoring tools.

Integrated risk management to align operational risks with overall enterprise risk strategies.

By following these steps, organisations can develop an effective operational risk management framework that enhances long-term resilience and sustainability.

Developing an Operational Risk Management Program

A well-structured operational risk management program is essential for businesses to navigate uncertainties and manage operational risk effectively. Here’s how organisations can build a strong program.

1. Establishing a Risk Management Framework

A risk management framework provides guidelines for identifying, assessing, and mitigating risks. Key elements include:

Risk appetite – Defining acceptable risk levels based on business objectives.

Governance structure – Assigning roles and responsibilities for risk managers and executives.

Risk reporting – Ensuring risk management practices are transparent and regularly reviewed.

2. Implementing Risk Strategies

Developing risk management strategies helps organisations minimise threats. These include:

Risk mitigation – Reducing financial losses through proactive controls.

Risk and control measures – Strengthening compliance with industry regulations.

Service provider management – Evaluating third-party risks in outsourced operations.

3. Enhancing Risk Management Capabilities

For an effective operational risk management framework, businesses must:

Invest in risk management discipline – Training employees on risk awareness.

Use management information systems – Leveraging data analytics to predict risks.

Integrate risk management efforts – Aligning operational risk with enterprise-wide strategies.

4. Continuous Improvement and Adaptation

The state of operational risk management is dynamic, requiring ongoing enhancements. Best practices include:

Reviewing risk levels – Assessing the impact of new threats.

Updating risk mitigation plans – Refining response strategies based on past incidents.

Strengthening oversight of operational risk – Ensuring compliance with evolving regulations.

By following these steps, organisations can build a strong operational risk management program that enhances business continuity, protects assets, and fosters long-term growth.

Conclusion

Effective operational risk management is essential for businesses to navigate uncertainties and prevent potential disruptions. By implementing a structured operational risk management process, organisations can identify, assess, and mitigate operational risks efficiently.

Key takeaways include:

Understanding the types of operational risks and their impact on business continuity.

Implementing a robust risk management framework to strengthen oversight.

Developing an operational risk management program that aligns with business goals.

Continuously improving risk management practices to adapt to evolving challenges.

A well-defined risk management strategy not only protects organisations from financial losses but also fosters resilience and long-term success. By prioritising effective operational risk management, businesses can confidently operate in an increasingly complex environment.

Leveraging WorkDash for Effective Operational Risk Management

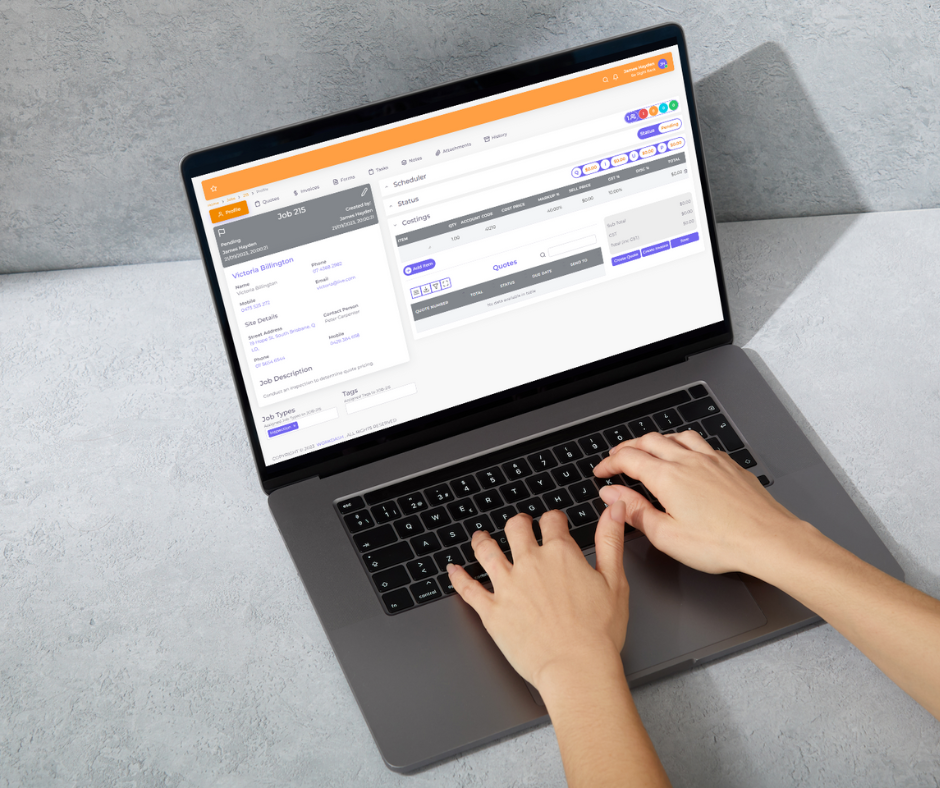

WorkDash is an advanced business management software that streamlines operational risk management by integrating automation, data analytics, and real-time reporting. Designed to enhance risk control, WorkDash provides businesses with the tools needed to identify, assess, and mitigate operational risks efficiently.

Ready to strengthen your operational risk management?