Table of Contents

Liquidity is a crucial factor in determining a business’s financial health. It refers to the ability of a company to convert assets into cash quickly to meet short-term liabilities. Without sufficient liquidity, businesses may struggle to cover operational costs, pay debts, or respond to unexpected expenses. This is why understanding liquidity, measuring liquidity ratios, and adopting strategies to improve cash flow are essential for long-term stability, particularly in maintaining accounting liquidity.

This guide explores the meaning of liquidity in business, the key liquidity ratios every business should monitor, and practical ways to improve business liquidity. From minimising expenses to refining pricing strategies, we’ll cover everything you need to ensure your business maintains a strong liquidity position.

Liquidity Meaning in Business

Liquidity in business refers to the ease with which a company can convert its assets into cash to cover short-term liabilities. A business with high liquidity can quickly access cash without significant losses, while a business with low liquidity may struggle to meet its financial obligations, leading to potential insolvency.

Liquidity is essential for maintaining smooth business operations. Companies with strong liquidity can handle unexpected expenses, seize new opportunities, and avoid financial distress. On the other hand, a lack of liquidity can lead to late payments, credit issues, or even a liquidity crisis, where a business is forced to sell assets to cover debts.

Why Liquidity is Important for Business Stability

Maintaining a highly liquid asset portfolio is crucial for financial health. a healthy liquidity position is vital for business growth and sustainability. Here’s why:

Ensures Financial Stability – A business with sufficient liquid assets can cover operational expenses, such as payroll and rent, without disruptions.

Improves Creditworthiness – Lenders and investors assess liquidity ratios before approving loans or investments. A company with a good liquidity ratio is more likely to secure financing.

Reduces Liquidity Risk – Low liquidity can lead to a cash crunch, where the company is unable to pay suppliers or employees on time, impacting the company’s liquidity.

Enhances Business Flexibility – Companies with high liquidity can invest in new opportunities, negotiate better supplier terms, and withstand economic downturns.

To effectively measure liquidity, businesses need to track key liquidity ratios, such as the current ratio, quick ratio, cash ratio, and liquidity planning. These metrics help assess a company’s ability to meet its short-term obligations.

How to Measure Liquidity in Business

Liquidity Ratios: The Key Metrics

To assess business liquidity, companies use liquidity ratios, which measure a company’s ability to cover its short-term liabilities with its available assets. The three most common liquidity ratios include:

Current Ratio – Measures whether a business has enough current assets to cover its current liabilities.

Formula:

Current Ratio=Current AssetsCurrent LiabilitiesCurrent Ratio=Current LiabilitiesCurrent Assets

A ratio above 1.0 generally indicates good liquidity, meaning the company has enough assets to cover its debts.

Quick Ratio (Acid-Test Ratio) – A stricter measure of liquidity that excludes inventory since some businesses may find it difficult to convert stock into cash quickly.

Formula:

Quick Ratio=Current Assets−InventoryCurrent LiabilitiesQuick Ratio=Current LiabilitiesCurrent Assets−Inventory

A quick ratio above 1.0 shows the company can meet obligations without relying on inventory sales.

Cash Ratio – The most conservative liquidity measure, considering only cash and cash equivalents.

Formula:

Cash Ratio=Cash and Cash EquivalentsCurrent LiabilitiesCash Ratio=Current LiabilitiesCash and Cash Equivalents

A high cash ratio indicates strong liquidity, but too much cash sitting idle may signal inefficiency.

How to Calculate Liquidity and Assess Business Health

To determine a business’s liquidity position, follow these steps:

Gather Financial Data – Extract figures for current assets, liabilities, and cash equivalents from the company’s balance sheet.

Compute Liquidity Ratios – Use the formulas above to calculate current, quick, and cash ratios.

Compare Industry Benchmarks – Different industries have varying liquidity expectations. Retail businesses, for example, may hold more inventory, while service-based businesses rely more on cash flow.

Monitor Trends Over Time – A one-time liquidity check isn’t enough. Businesses should track these ratios regularly to identify patterns and take action if liquidity declines.

Businesses that actively measure liquidity and manage their finances accordingly can avoid liquidity risks, ensuring they always have cash on hand to improve your liquidity. enough cash to cover their obligations.

Strategies to Improve Business Liquidity

Minimise Expenses and Reduce Overhead to Improve Business Liquidity

One of the most effective strategies for strengthening business liquidity is reducing unnecessary expenses. Cutting costs increases cash reserves, ensuring your company has enough liquid assets to meet short-term obligations. A well-managed expense structure improves liquidity ratios and minimises financial risks.

Audit and Eliminate Non-Essential Costs

To optimise liquidity in business, conduct a thorough audit of operational expenses and identify areas where spending can be reduced:

Review Business Subscriptions – Many businesses pay for unused or redundant software, tools, or memberships. Canceling unnecessary subscriptions helps improve cash to cover essential costs.

Downsize Excessive Office Space – If you lease a large office but have transitioned to remote work or a hybrid model, consider moving to a smaller space to lower rent expenses.

Optimise Utility and Operational Costs – Reduce electricity, internet, and office supply costs by implementing energy-efficient solutions and renegotiating service contracts.

Negotiate Better Deals with Suppliers and Vendors

Building strong relationships with suppliers can affect your business liquidity positively by securing better pricing:

Renegotiate Existing Contracts – Work with suppliers to negotiate bulk discounts, extended payment terms, or lower rates.

Compare Multiple Vendors – Regularly review alternative suppliers to ensure you’re getting the most cost-effective products or services.

Leverage Early Payment Discounts – Some vendors offer discounts for early or upfront payments, improving liquidity ratios by lowering costs.

Switch to Cost-Efficient Solutions

Adopting cost-saving strategies can help businesses improve their liquidity while maintaining operational efficiency:

Outsource Non-Core Functions – Instead of maintaining an in-house team for services like IT support, payroll, or marketing, consider outsourcing to reduce payroll expenses.

Automate Routine Tasks – Use automation tools for invoicing, payroll, and customer relationship management (CRM) to lower administrative costs.

Transition to Remote or Hybrid Work – Reducing the need for office space and utilities improves business liquidity by cutting fixed costs.

Monitor Overhead Costs Regularly

Maintaining healthy liquidity requires continuous monitoring of fixed costs such as rent, salaries, and utilities:

Set a Monthly Overhead Budget – Establish spending limits for fixed and variable costs to ensure they align with revenue.

Track and Adjust Spending – Regularly review financial reports and adjust expenses based on revenue fluctuations.

Reduce Unnecessary Payroll Costs – If labour costs are a burden, consider optimising employee scheduling or hiring contract workers for temporary needs.

Improve Invoice Collection and Track Accounts Receivable for Better Business Liquidity

Delayed payments can severely impact business liquidity, making it difficult to meet short-term financial obligations. A well-managed accounts receivable process ensures steady cash flow, enhances liquidity ratios, and reduces dependency on external funding. Implementing an effective invoice collection strategy is essential for maintaining healthy liquidity and business stability.

Send Invoices Promptly

A slow invoicing process can lead to cash shortages, increasing liquidity risk. To ensure timely payments:

Issue Invoices Immediately – Send invoices as soon as a product or service is delivered to accelerate the cash inflows.

Use Digital Invoicing – Electronic invoices reach customers faster and facilitate quicker payments.

Include Clear Payment Instructions – Ensure invoices specify the due date, payment methods, and penaltiesfor late payments.

Set Clear Payment Terms and Encourage Early Payments

Establishing firm but fair payment terms can help improve liquidity:

Require Upfront or Partial Payments – Requesting a deposit or milestone-based payments ensures a steady cash flow.

Offer Early Payment Discounts – Incentivise customers with discounts for early settlements, improving the liquidity ratio.

Enforce Late Payment Penalties – Charge interest on overdue invoices to encourage timely payments and mitigate cash flow disruptions.

Follow Up on Outstanding Invoices

Many businesses struggle with liquidity issues because of unpaid invoices. Proactively tracking accounts receivablehelps maintain good liquidity:

Send Payment Reminders – Use automated email reminders to notify customers about upcoming or overdue payments.

Make Direct Contact – Call clients with past-due invoices to discuss payment arrangements and prevent further delays.

Engage Debt Collection Services – As a last resort, consider hiring professionals to recover outstanding debts while protecting business liquidity.

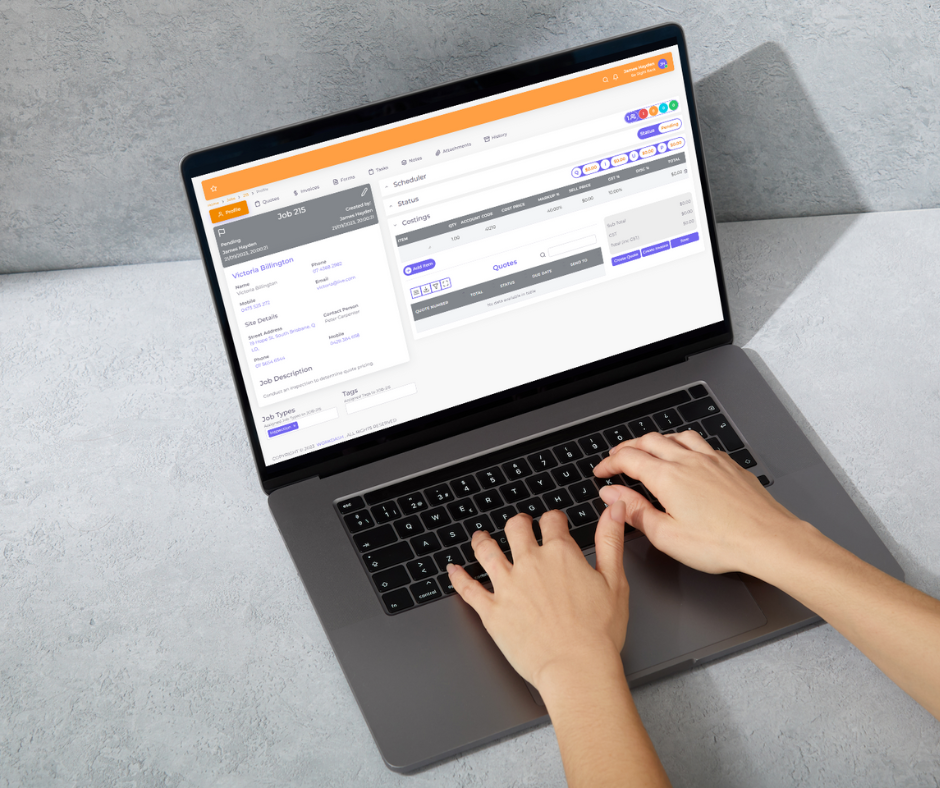

Use Automated Billing and Payment Tracking Systems

Leveraging technology can help businesses measure liquidity, improve payment efficiency, and reduce administrative burdens:

Implement Accounting Software – Use platforms that allow businesses to automate invoicing and track cash to cover expenses.

Enable Online Payment Options – Offering digital payments (e.g., credit cards, PayPal, direct bank transfers) speeds up collections and improves business liquidity.

Monitor Accounts Receivable Regularly – Run weekly or monthly reports to assess outstanding invoices and adjust liquidity planning accordingly.

Sell Liquid Assets & Manage Accounts Payable Efficiently

Sometimes, selling underutilised assets is necessary to free up cash quickly and boost business liquidity.

Identify Non-Essential Assets – Sell equipment, inventory, or real estate that isn’t contributing to revenue.

Lease Instead of Buying – Reduce large capital expenditures by leasing office space, vehicles, or machinery instead of purchasing outright.

Manage Accounts Payable Wisely – Negotiate extended payment terms with suppliers to delay cash outflowswithout incurring penalties.

By effectively managing accounts payable and liquid assets, businesses can maintain a healthy liquidity positionwhile continuing operations smoothly.

Advanced Liquidity Management Techniques

Managing Cash Flow to Avoid Liquidity Risks

A business with poor cash flow management is at risk of liquidity problems. Ensuring that cash inflows exceed outflows is key to maintaining strong business liquidity.

Key Strategies for Effective Cash Flow Management

Create a Cash Flow Forecast – Predict income and expenses to prevent cash shortages.

Monitor Cash Inflows and Outflows – Track money entering and leaving the business to detect financial issues early.

Optimise Payment Schedules – Pay suppliers on time but avoid early payments that deplete cash reserves.

Reduce Debt Reliance – Minimise dependence on loans by increasing cash reserves through efficient expense management.

By actively managing cash flow, businesses can avoid liquidity risks and ensure long-term financial stability.

Accessing Credit and Refinancing Debt for Better Liquidity

When a business faces liquidity challenges, securing financing can be a solution. However, it’s essential to choose credit and refinancing options wisely to avoid worsening financial strain.

Ways to Use Credit for Better Liquidity

Business Lines of Credit – Flexible borrowing options allow businesses to withdraw funds as needed.

Short-Term Loans – Provide quick access to cash but should be used cautiously to avoid excessive debt.

Invoice Financing – Convert unpaid invoices into immediate cash through factoring companies.

Refinancing Debt – Replace high-interest loans with lower-rate alternatives to improve liquidity.

Properly managing credit and debt refinancing can help businesses maintain liquidity while avoiding financial distress.

Inventory Management and Monitoring Cash Equivalents

Holding excess inventory can tie up cash and reduce business liquidity. Effective inventory management ensures that cash isn’t locked into unsold products.

Strategies for Efficient Inventory Management

Adopt Just-in-Time (JIT) Inventory – Reduce stock levels by ordering materials only when needed.

Monitor Inventory Turnover – Track how quickly inventory is sold and adjust stock accordingly.

Sell Slow-Moving Products – Offer discounts or promotions to clear stagnant inventory and free up cash.

Additionally, maintaining sufficient cash and cash equivalents, such as savings and marketable securities, ensures quick access to funds in case of liquidity challenges.

Boosting Business Liquidity Through Revenue Growth

Increase Sales and Optimise Pricing

Revenue generation is one of the most effective ways to improve liquidity in business. A company that consistently increases sales and maintains profitable pricing strategies will have stronger cash flow and financial stability.

Strategies to Increase Sales and Revenue

Expand Market Reach – Target new customer segments, explore online sales, or expand into new geographical areas.

Enhance Customer Retention – Implement loyalty programs, personalised offers, and excellent customer service.

Introduce High-Margin Products – Focus on selling goods or services that yield higher profit margins.

Offer Bundled Services or Upselling – Increase the average transaction value by offering related products or premium options.

Optimising Pricing for Better Liquidity

Analyse Market Trends – Monitor competitors’ pricing and industry demand to ensure competitive rates.

Adjust Pricing Based on Costs – Regularly review operational expenses and adjust prices to maintain profitability.

Offer Flexible Payment Plans – Encourage larger purchases by allowing instalments or financing options.

By implementing strategic sales growth and pricing techniques, businesses can generate more revenue and strengthen their liquidity position.

Stay on Top of Invoicing and Sweep Accounts for Maximum Efficiency

Many businesses face liquidity challenges due to inefficient invoicing and poor financial management. Staying organised with billing and cash management can prevent liquidity issues.

Improving Invoicing Efficiency

Send Invoices Immediately – The sooner invoices are issued, the faster payments will be received.

Use Digital Payment Methods – Provide multiple payment options, including credit cards, direct transfers, and online portals.

Implement Auto-Reminders – Set up automated systems to notify customers of upcoming or overdue payments.

Offer Early Payment Discounts – Encourage clients to pay faster by providing small incentives.

Using Sweep Accounts to Automate Cash Management

Automate Cash Transfers – Sweep accounts automatically move excess cash into interest-earning accounts to optimise liquidity.

Reduce Idle Cash Balances – Avoid keeping too much cash in non-productive accounts, ensuring funds are actively used.

Improve Cash Availability – Ensures money is always available for payments while earning returns on unused funds.

By combining effective invoicing practices with automated financial management, businesses can significantly improve liquidity and cash flow stability.

Conclusion: Strengthening Business Liquidity for Long-Term Success

Ensuring a healthy liquidity position is critical for the success and stability of any business. By effectively managing cash flow, reducing debt, optimising pricing, and maintaining efficient invoicing, businesses can build a strong financial foundation and avoid liquidity risks.

Tracking key liquidity ratios and implementing strategic financial practices will help businesses remain financially stable, even in challenging economic conditions. Whether through cutting costs, improving sales, or leveraging credit wisely, businesses that prioritise liquidity management are better positioned for long-term growth and resilience.

FAQs About Business Liquidity

Liquidity refers to a company’s ability to convert its assets into cash quickly to meet short-term financial obligations. A business with high liquidity has sufficient cash flow and liquid assets to cover expenses, while a low liquiditybusiness may struggle to pay debts.

Maintaining strong liquidity ensures a company can operate smoothly, pay suppliers and employees, and respond to unexpected financial challenges. Poor liquidity can lead to cash flow problems, financial instability, and potential insolvency.

A good liquidity ratio depends on the industry, but generally:

Current Ratio (Current Assets ÷ Current Liabilities): Above 1.5 is ideal

Quick Ratio ((Current Assets – Inventory) ÷ Current Liabilities): Above 1.0 is considered healthy

Cash Ratio (Cash & Cash Equivalents ÷ Current Liabilities): 0.5 or higher is preferable

To improve liquidity, businesses should:

Minimise expenses and reduce overhead

Increase sales and optimise pricing

Manage accounts receivable and invoicing efficiently

Sell non-essential assets and refinance debt

Use credit lines and sweep accounts to maintain cash flow

Liquidity refers to short-term financial health—a business’s ability to meet immediate obligations. Solvency, on the other hand, indicates long-term stability—whether a business has enough assets to cover total liabilities over time.

Liquidity ratios assess a company’s ability to pay short-term liabilities by comparing liquid assets to debts. They are essential for evaluating financial strength, managing risks, and making informed business decisions.